Connecting the Unconnected

How do you bring internet to a country of more than 1 billion people?

In 2016, I remember sitting on a train travelling to my grandparents town in India. I’d made this trip dozens of times on prior visits to India with my family. To prepare for the 5 hour train ride, I would usually download a few movies to watch on my laptop or buy a few comic books at the station. This time, I ended up streaming the first season of Daredevil in flawless quality whilst on 4G. I was amazed.

Just a couple months earlier, I was on a road trip to Canberra and since I wasn’t driving I had a few movies I wanted to watch. About halfway through the trip, my Netflix started buffering and after restarting it a few times with no change, I ended up sleeping the rest of the way.

In Australia, we’re used to having pretty mediocre internet. But that trip to India in 2016, really opened my eyes to how far behind Australia was on the technological curve. On previous trips to India I could barely connect to 2G, let alone 3G. The company behind this revolution?

Reliance Industries. The trillion dollar* business you've probably never heard of. (*Rupee)

What is Reliance Industries?

Founded by Dhirubhai Ambani in 1966, Reliance started off as a polyester and textiles business before entering the petrochemicals and telecommunications industries in the 90s. After passing away in 2002, Dhirubhai's two sons, Mukesh and Anil took over the business with Mukesh as the chairman and Anil as the vice-chairman. As of 2021, one of those brothers is worth US$82 billion and the other is bankrupt.

The Reliance empire spans across a diverse mix of businesses including energy, petrochemicals, natural gas, retail, telecommunications, mass media, and textiles. Reliance is India’s largest company by market cap and is also one of its most profitable companies. Today’s story starts in 2005 after a bit of a power struggle between the two brothers, leading to the Reliance conglomerate being split in half. Big bro Mukesh got the petrochemicals, oil and gas exploration, refining and textiles divisions and lil bro Anil was given the telecoms, energy and financial services business.

Keeping Anil’s story short, separating the Reliance empire was the beginning of the end for him. Despite grandiose visions and an MBA from Wharton, Anil proceeded to accumulate millions in debt, and destroyed more than 90% of shareholder wealth from his half of Reliance. Fortunately for the Ambanis, Mukesh was a bit more sensible in his approach to business with laser focus on building and owning the market in various verticals, which brings us to Jio.

The power of Jio

In 2010, the Indian Government auctioned off both 3G and 4G spectrums. The existing players focused on getting their hands on 3G as they focused on upgrading their dated infrastructure. In a classic case of underpriced attention, the 4G auction was left untouched by the big players and a small company called Infotel was able to scoop up 4G rights in 22 regions of India. The day after the auction, Reliance swooped in and acquired 95% of Infotel for US$1 billion announcing their intentions to the rest of India. Critics emerged immediately, with The Wall Street Journal stating that “by the time Mukesh Ambani builds a 4G wireless business, rivals will have had the chance to sign up millions of customers for 3G services, leaving a smaller pool of potential broadband subscribers". However Mukesh met his critics by stating that this move would "pole-vault India's economy into the digital world at an accelerated pace."

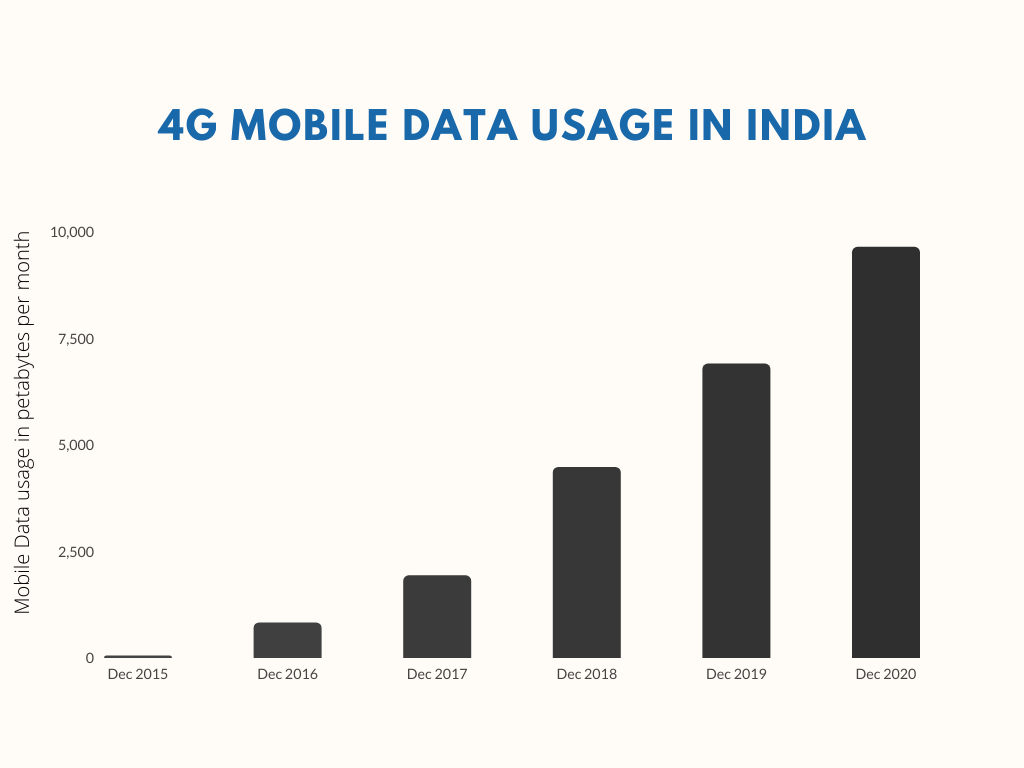

When Jio launched in 2016, that’s exactly what happened. Jio adopted a classic Silicon Valley strategy by offering customers free voice calls and data for a three to six-month window and then charging a few dollars for the data once the 'trial' period was over. Jio essentially broke the consumer telecommunications market in India, causing four mergers and two bankruptcies (incl. Anil's Reliance Communications).

Jio's impact on India in just a few years has been revolutionary for a country that was largely disconnected from the rest of the world. It unlocked massive growth in the Indian tech ecosystem in creation, consumption and capital.

Jio’s future

If owning India's biggest telecoms business wasn't enough, Reliance also owns Jio Fiber, a wired broadband service, and Jio Infratel, which owns and manages a portfolio of wireless towers. Whilst Jio controls much of the underlying infrastructure, the path from here is up as they build out a host of digital services from payments to education.

However, can Jio realistically build out a whole ecosystem of apps?

Whilst Jio has unique characteristics with enormous market share in a huge market, its early attempts and consumer adoption of Jio's apps and services has been quite poor by its own standards.

For example, Flipkart which is essentially the Indian version of Amazon, competes with JioMart. Whilst JioMart was focused on onboarding thousands of offline corner stores to its platform, Flipkart quickly built out its ecommerce platform, taking out 31.9% of the market and has the backing of Walmart and Tencent. Amazon has also built up a strong position in the market with a market share of 31.2% after spending over US$6.5 billion. For Jio to compete in this vertical, it’ll need to execute incredibly well and has set the platform to do that by partnering with Facebook through WhatsApp and acquiring Fynd, an omnichannel ecommerce platform.

A similar story is unfolding on the payments side where Jio has a fair few competitors to contend with. Softbank backed Paytm processes more than 1 billion transactions monthly, not to mention Flipkart backed PhonePe and Google Pay also dominate the market. Additionally, WhatsApp has also made a push into the payments market with a view towards capturing market share through the JioMart partnership, making it slightly confusing as to what Jio hopes to achieve with its JioMoney product.

It’s not a surprise that Mukesh has taken the vertical path to building out Jio. It's what his father did in the early days of Reliance, from controlling import licenses on yarn to textiles manufacturing, petrochemicals and petroleum refineries. It would make more sense to copy the Tencent model and push WhatsApp as the WeChat equivalent within India. Reliance would do well to become a growth investor and back winners in each market. By loosening its grip on the value chain, it can pursue a more capital efficient approach allowing it to dedicate resources elsewhere.

Jio fuelled startup boom

As alluded to above, Reliance would do well to copy the Tencent model, but take it further.

Breaking it down, there are two ways Reliance can capitalise on the Jio platform:

Provide massive amounts of funding to Indian startups

Serve as a strategic investor to global startups and support their market entry into India

1. Funding Indian startups

The bull case for Indian tech and the economy is that it is following China's footsteps roughly 5-6 years behind. There are a few important tailwinds of note that place India in a favourable position for enormous growth in the next 10 years.

Upward income mobility: By 2030, India will double the current level of middle and high income households, which in turn will drive higher consumer spending (~80% of total spend in 2030)

Dispersed urbanisation: Jio helped solve the lack of technology infrastructure for many rural towns in India. Urbanisation will continue by tackling poor infrastructure and access to retail and financial inclusion. By 2030, 40% of Indians will live in urban cities.

Internet usage: Ignited by Jio, internet coverage and connectivity is widespread in India with around 600 million internet users as of 2020 and is expected to grow further to around 900 million by 2025.

Digital natives: In 2030, India will have about 370 million Gen Z consumers who have grown up with ubiquitous internet and smartphones. Ecommerce will continue to grow and is expected to quadruple to US$100-120 billion in 2025.

According to Venture Intelligence, there are sixty Indian unicorns, and combined, these startups are worth ~US$206 billion. Despite only starting to create unicorns consistently from 2018, India already has the third most unicorns following the US and China, and has minted 24 unicorns in 2021.

Hence, the case for Jio to invest rather than acquire is a no brainer. The synergies generated by investing in emerging Indian startups are enormous given the size of the Jio platform. Furthermore, from an ecosystem perspective, it turns Reliance from a large threat to a supportive sponsor. Rather than bullying early-stage startups into submission through price wars, by backing potential competitors Reliance can help grow the pie for everyone.

2. Funding global startups

The Indian government has been quite resistant in letting foreign companies do business within India. Mukesh Ambani aligns with this resistance, making multiple passionate speeches on the need to ensure ownership and control of Indian data stays in Indian hands. However, the lack of external competition can be a hindrance to the startup ecosystem by constraining innovation.

An interesting way to promote competition whilst also maintaining control over Indian data would be for Reliance to invest in overseas startups. Jio would be able to serve as a channel partner similar to their Facebook partnership mentioned earlier, or their collaboration with Google to launch an affordable Jio phone. By doing so, it gives international startups a pathway into India and a large user base to work with, yet Jio would still control the data of the end user. The introduction of international businesses and increased competition is good for the Indian startup ecosystem. It will likely lead to more jobs created within India which exposes more people to cutting edge technology, which should hopefully lead to even more innovation. With greater innovation, comes greater value creation for the Indian economy which in turn will increase its rate of economic growth.

By adopting this approach, Reliance, and by extension the Indian government can encourage foreign businesses to expand into India on their terms. Moreover, there's likely reverse synergies for Reliance to expand its operations more globally through their portfolio companies. From a business perspective, this would provide higher upside than continuous proliferation of the Indian market.

Reliance to further dominate India or make a mark on the world?

Whilst Reliance will probably succeed regardless of the approach they take, it would be more interesting to see them invest globally. As mentioned above, by becoming the conduit to India for foreign business, Reliance will truly cement its place as the main infrastructure layer within India. Moreover, for Indian startups to make their mark on the world, there are better strategic partners globally compared to Reliance. If Indian founders want to play the long game, and build a global legacy, it would make more sense to use Reliance as a short-term partner to own the Indian market within their chosen vertical and then quickly look to move overseas.

Comment below your thoughts on what Reliance should do moving forward. Should they invest locally or globally?

Make sure to subscribe now to not miss the next article.

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you soon!

Abhi

An eye opener, memes were hilarious and relatable, thank you for bringing joy to my day

First.