Decentralising the 'Decentralised'

A deep dive into Aleph.im - the AWS of web3

Welcome to all the new subscribers over the last few weeks! You can read my last article on Metamaterials here.

Stay up to date with Superfluid by subscribing here:

On December 8, 2021, popular a16z-backed, decentralised exchange dYdX went down for roughly 10 hours due to an AWS outage. The outage also hit Coinbase and Binance.

Why does this matter?

Cryptocurrencies were born with the vision of a decentralised future, where no single person or entity has full control. However, a significant portion of decentralised projects heavily rely on Google, Amazon or Microsoft to host their projects. In fact, according to Amazon, 25% of all Ethereum workloads run on AWS, and more broadly, ~70% of Ethereum’s nodes run on centralised services.

As a result, these supposedly decentralised projects and protocols are only decentralised in name, and not really in execution. This is likely due to the lack of proper decentralised cloud infrastructure at the time of inception for many of these projects. Still, taking the easy route flies in the face of what true decentralisation means.

True decentralisation is supposed to be resilient to regulatory pressure. By using centralised services, regulators have the authority to cut off access to servers and prosecute founders of projects. Obviously, this isn’t a great thing if decentralisation is the ultimate goal.

Interestingly in crypto, consumer-based products have taken off without the necessary decentralised infrastructure supporting them. More recently, we’ve seen Filecoin, Arweave and Golem pop up as higher-profile projects in this space – but none of these is an all-encompassing solution to solving the decentralised cloud computing problem.

Enter Aleph.im.

Aleph is a cross-chain network that facilitates decentralised cloud storage and cloud computing. It has true cross-chain compatibility with a number of smart contract-based Layer 1 chains such as Ethereum, Solana, Polkadot, Cosmos, Avalanche and NULS. In a world where blockchains aren’t fully decentralised, Aleph provides an all-in-one solution for dApp developers to ensure the decentralisation of their projects across 70 nodes.

The Origins Story

Founded by Jonathan Schemoul (aka Moshe Malawach) in 2019, Aleph’s journey has taken a few detours to get to where it is today. Moshe initially got involved with blockchain development through the NULS project, which is a Layer 1 blockchain. Whilst at NULS in 2018, Moshe’s main contribution was through building out a full block explorer (a platform where anyone can look at the transactions being processed on the blockchain). Whilst working on the block explorer, Moshe, worked on various features to add IPFS pinning and database entries. This served as the initial seed that sparked Moshe into building Aleph as a standalone project.

The initial days of building Aleph were rough. Moshe and his co-founder Claudio (a designer, who he met at NULS) were the main leaders of the project, with Moshe grinding hard and bootstrapping the project as the sole open-source developer. Given the open-source nature of the project, Moshe tried to get others on board, and whilst there were more than 10 people collaborating on the project, they were all part-timers chiming in for an hour here and there.

At the end of 2018, Moshe had lined up several big investors for the project in order to bring on more developers. However, when it came time to process payments and finalise agreements, all of the investors pulled out. This trend continued for all of 2019, where Aleph remained fully-self funded by Moshe who also closed down his consulting business in order to fully focus on Aleph.

In order to bootstrap the project, Moshe spun out some nodes on the NULS blockchain, and in exchange for people staking on his nodes and giving up their staking revenue, he gave out Aleph tokens (built on the NEO blockchain) that could hopefully be worth something in the future. This strategy yielded $10-15k –not enough to pay themselves, but enough to pay for a few servers to keep Aleph alive.

Moshe had also decided to help out a failed ICO project called PikcioChain. PikcioChain aspired to allow users to choose who would have access to their data and receive compensation for sharing data. Given a few synergies between the two projects, the PikcioChain decided to give its IP and code base to Aleph. In exchange and out of goodwill, Moshe airdropped PikcioChain holders some Aleph tokens at a ratio of 1 $ALEPH to 5 $PKX.

Both of these moves helped bootstrap the project and provide some publicity and visibility to the project. Eventually in June 2020, several larger projects started reaching out to Moshe to use Aleph. These were Ethereum based projects and as a result required Aleph to transition their tokens from NEO onto Ethereum. In doing so, Moshe initialised a small Uniswap liquidity pool using his own personal funds so that Aleph tokens could be traded.

This coincided with DeFi summer of 2020, and the price of ALEPH went from 1c to ~10c and then subsequently back down to 1c. Whilst the price of the token and value of the project skyrocketed and plummeted almost overnight, this again increased the visibility of the project and led Aleph to initialising liquidity pools with tokens from the public (as opposed to funding it themselves). This allowed these liquidity providers to earn Aleph tokens.

Towards the end of 2020, as Aleph was gaining more momentum, the team released the capability for anyone to launch a Core Channel node. Off the back of this, Moshe again started speaking to prospective investors, and fortunately this time the reception was more positive. Aleph was able to complete OTC rounds with Alameda and Rarestone, raising just enough money to fund the team for at least a year.

Aleph’s solution

While figuring out how to keep the lights on, Moshe and his team have built out a product that rivals AWS Lambda in terms of providing compute power as well as a cloud storage solution on the side. Aleph sits independent of the typical layer structure of crypto infrastructure and provides compute power and cloud storage across Ethereum Virtual Machine (EVM) chains, substrate ecosystems (Polkadot and Kusama), Cosmos, and other chains (Solana and Near).

Integrating with so many different chains can be a technical challenge and for portions of the Aleph ecosystem, this has been straightforward and for others it has been slightly trickier. Reading messages and data is simple if the address is publicly available and not obfuscated (e.g. NEAR protocol).

What is harder to implement is writing messages, creating database entries, requesting storage as these commands need to be ordered across all chains to have a common state. Aleph’s nodes write these messages on-chain and as a result these messages need to be ordered chronologically. Providing support for multiple chains poses an issue here as different chains might be out of sync with the chronological order of the messages.

As such, it is only possible to write messages once an hour on Ethereum, with capability to do so on Solana soon to follow. It is unlikely that writing messages will be able to be done in quicker intervals due to the synchronisation issue.

More recently, Aleph has started building products on top of their infrastructure solution. Their first product is centered around indexing large amounts of data. To date, the team has made a conscious effort to index all of Solana’s transactions in order to service a growing ecosystem. This is done through using micro Virtual Machines in order to index the data periodically or whenever the dApp requests it.

Decentralising the Network

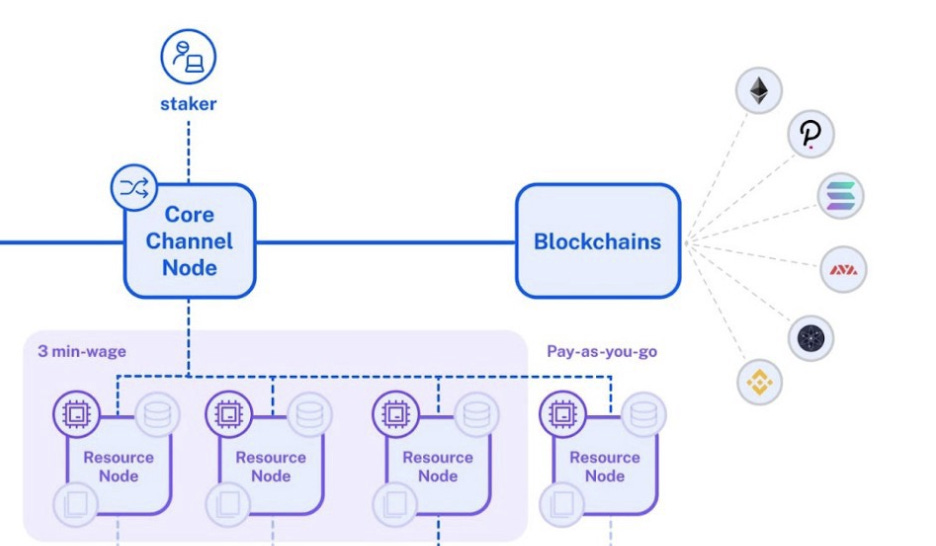

In order to provide this solution in a decentralised manner, Aleph makes use of an extensive node network. Aleph’s network consists of two node types. Core Channel Nodes serve as the main management layer of the network. They handle network validation, security and workload management for the network. Additionally, they are also able to deploy resource nodes. To operate a Core Channel node, you will need to stake 500k Aleph tokens at a minimum.

Whilst both Core Channel and Resource nodes are able to provide services, such as database, file storage and compute power, resource nodes allow the network to be elastic. This means that the network is able to quickly expand or contract its resources to meet changing demands. Each Core Channel node can deploy as many resource nodes as they would like, however in the first release of the resource node network, only 3 resource nodes are incentivised with ALEPH tokens, with additional resource nodes receiving rewards when utilised.

According to node operators, setting up nodes on Aleph is unfortunately not a simple task. As with any growing startup, there are a few kinks in the system and given Moshe’s almost sole focus on keeping the business alive, some of the documentation is lacking detail. However, making up for this is a passionate and growing community of Node operators that live on Telegram.

For new Node Operators this is a blessing in disguise. The community is active and always willing to help with whatever is required to bring more nodes online. Moreover, they are willing to pool together resources in order to hit the 500k $ALEPH token threshold to run a node. Furthermore, some operators have even set up side hustles involving the ongoing setup and management of nodes. Having such a strong community of node operators has also led to a strong referral network when reaching out to new dApps and projects to use Aleph as their cloud solution.

Using Aleph

Similar to setting up a node on Aleph, using Aleph to host your dApp requires a bit of troubleshooting and hand-holding from the team. But once the set-up is initiated and running, there shouldn’t be any performance tradeoffs despite the distributed nature of the network. As such, Aleph has been adopted by game developer Ubisoft as a storage solution for their NFT marketplace, Ubisoft Quartz.

Through Aleph’s micro Virtual Machines, Aleph will be able to securely store and generate the metadata for these NFTs. Traditionally NFTs are static and the attributes for each NFT do not change as users transfer them amongst themselves, however, Ubisoft’s implementation of NFTs will be dynamic. Aleph was crucial in ensuring Ubisoft’s NFTs are actually dynamic and work as intended. As a side note, Ubisoft also established a Core Channel node on Aleph in early 2021.

In addition to Ubisoft, a few large Solana based DeFi protocols such as Serum, Orca and Friktion as well as Australian-based derivatives trading platform Zeta Markets as an indexing solution. Serum, specifically posed a huge challenge for the Aleph team to index due to its fully on-chain central limit order book and matching engine.

However, going through these initial data wrangling challenges has built some defensibility for Aleph. When speaking to a contributor from the Zeta Markets team, they mentioned that since Aleph had already indexed Serum, one of the core DeFi building blocks on Solana, it made the decision easy to go with Aleph as the MVP for their trade data dashboard. Given that Solana handles 1000s of transactions per second, it would make it incredibly difficult to build this out in-house or by another competitor. In addition, the team spoke about how easy it was to plug Aleph into their existing tech stack and that they were even given 1 dedicated resource to help them make the most of Aleph’s capabilities.

Aleph’s Business Model (Tokenomics)

Aleph’s business model functions similarly to most other crypto-based projects and it is all centred around the $ALEPH token. At the moment, Aleph has a maximum supply of 500 million tokens. They are split up into the following pools:

Innovation (50 million) - This pool is intended to fund ecosystem projects and grants for future projects. 900k tokens will be unlocked per month, however, unused tokens will remain in the pool to be used as needed.

Marketing (60 million) - As the name suggests, this pool will be used for marketing efforts. 1 million tokens will be unlocked per month. Half of the unused tokens in a given month will be moved to the innovation pool and the other half will remain in the pool for future use.

Company (150 million) - This pool will be used to fund company operations and to fund bonuses for Aleph employees. 2.5 million tokens will be unlocked every month with tokens remaining in the pool if they are unused.

Business Development (120 million) - Permanently unlocked, this pool will be used to increase the distribution of Aleph tokens in circulation and also for various business development initiatives.

Incentive (100 million) - The incentive pool is intended to payout node operators for staking their token and to liquidity providers. 45 million Aleph tokens were already distributed during the initial bootstrap of Aleph (rewards to those who staked on Moshe’s NULS nodes), leaving 55 million left to be distributed. At the moment, Node operators can expect to receive 6,428 $ALEPH per month, 450,000 tokens per month will be distributed to liquidity providers on Uniswap and other platforms and 450,000 tokens per month will also be distributed to those who continue to stake their NULS on Moshe’s nodes.

NULS Foundation (20 million) - This pool is 100% locked and intended to vest overtime to ensure future collaboration and continued support between the NULS foundation and Aleph.

At the moment, Aleph has ~37% of its tokens in circulation which is slightly lower than most other projects, however, given the lock-up periods and clear use cases for the locked tokens, this should not be a huge issue.

For Node operators

It should be noted that Aleph will likely refresh its tokenomics in the next few months as it rolls out the resource node pool. Once this rollout occurs, Core Channel nodes will only receive 70% of the rewards if they do not have any resource nodes linked. For every resource node linked up to 3, core channel nodes will receive an additional 10% of rewards.

Additionally, resource nodes will be able to earn a minimum wage of 550 $ALEPH tokens per month. Once this kicks in, incentives for liquidity providers will stop in order to balance the token emissions. Furthermore, the Incentive pool will receive a top-up of a further 100 million tokens (taking it to 200 million), with further details expected to be released in February.

For Aleph users

For dApp teams to use Aleph, they will need to hold x tokens. Aleph’s nodes refresh user balances every hour to ensure the minimum threshold is being met. If the balance dips below this amount, the user's data gets sent to trash temporarily and the service is stopped. If there is at least one node on the network with the user’s data, then it is possible to recover the information once the balance has been replenished back to the minimum amount.

As the resource node network rolls out, Aleph intends to switch to a ‘Pay as you go’ method more in line with AWS or Google's billing policy. This shift is largely due to the elasticity of the resource node network being able to scale up or down when required. It will also reduce the monetary barrier in adopting Aleph as a decentralised cloud computing and storage solution.

Competition

Decentralised Storage:

Filecoin, one of Aleph’s largest competitors, serves as a storage marketplace, aiming to connect storage providers with those that need to store data in a decentralised way. As a result, pricing fluctuates based on demand and supply. Compared to Aleph’s current model, this makes it hard for users to forecast what they need to pay to use Filecoin. Indeed, as Aleph moves towards a PAYG model, the same issues may arise. Furthermore, whilst Filecoin’s network is decentralised, the storage is not. Files are stored on a single miner rather than distributed across multiple nodes like in Aleph’s solution. This poses the same issues as using AWS (centralised source, can be prone to going down etc) except at a higher price.

Arweave provides permanent storage to its users by incentivising storage providers to store data for long periods of time. Users pay a premium cost upfront to store the data, which works in a similar way to Aleph in that users need to purchase and hold Aleph tokens to use the network. Additionally, Arweave’s network is distributed with individual storage providers incentivised to host the entire network continuously. However, given the openness of blockchain, this means all content posted on Arweave is public and tamper-proof which can pose problems for developers when hosting on Arweave. Aleph’s network on the other hand is shielded from prying eyes and can be iterated upon as required.

Decentralised Compute:

Golem is a decentralised cloud computing solution that allows anyone to sell their idle computational power to consumers to process tasks and power applications. The network is fully distributed in that computational tasks are broken into pieces and spread across various providers. This methodology is similar to Aleph and allows for elastic computing. However, Golem is solely focused on Ethereum based projects rather than being chain agnostic like Aleph.

Akash is another decentralised cloud computing solution that functions more similarly to Amazon VPS. This means that whilst Aleph is triggered by a specific action or call, Akash runs continuously without shutting down. This in turn means it’s able to run more centralised applications, however, it is in use when it doesn’t need to be. As such, it is purely dependent on what sort of service the dApp requires.

Indexing

TheGraph is a decentralised protocol for indexing and querying blockchain data. With TheGraph, anyone is able to request data to be indexed, however, curators determine which data is actually worth indexing. Whilst Aleph gives the project team the power of indexation, TheGraph places the onus on the end consumer of the data to dictate what needs to be indexed. From a computational efficiency perspective, this could be more prudent as TheGraph doesn’t need to unnecessarily index data when it likely will never be used. However, this does make it inconvenient for the consumer in accessing the data that they need due to the time delay of requesting the data as well the chance that their request won’t be curated.

Ultimately, whilst there are competitors for each of Aleph’s verticals, there is no singular full-service competitor, nor a competitor that is truly multi-chain. There are pros and cons to this. Being a full-service product allows Aleph to cross-sell its services (such as it’s indexing capabilities) and generate more revenue for the network as well as grow the ecosystem. Moreover, being multi-chain from the start gives Aleph some defensibility to its product which will allow it to continue doubling down on its own ecosystem. Alternatively, individual competitors may be able to develop best-in-class products and offer streamlined services and support to their customers. Moreover, given the nascency of the space, it is hard to determine whether being multi-chain is important or whether it simply slows down the development cycle due to needing to cater to different types of layer 1 architecture.

The Future of Aleph

So what’s next for Aleph?

They've just raised a US$10 million seed round led by Stratos Technologies, Zeeprime, NOIA Capital and Bitfwd Capital as well as Race Capital’s Chris McCann. Whilst there are a fair few investors in this round, Moshe made a point to prioritise and include those who wanted to contribute to the network and host a node themselves. This simple act shows where Moshe’s real focus is. Building a valuable business is a great achievement, but to him, building a beautiful and great product is even more important. And he’ll only be able to do that if more people stake their Aleph tokens and host their own nodes.

With this fundraise, Moshe will be able to continue to do that by hiring more developers to help continue building out the product and auxiliary features. Aleph has a long line of interested parties and will look to hire some onboarding support staff in order to service these customers.

From an organisational perspective, Aleph is exploring options to turn the main company entity into a DAO or Foundation which will help bolster and formalise its community-building efforts. By moving in this direction, Moshe will essentially be relinquishing some of the control he’s had over the product, but also allow the product to return to its open-source roots, effectively decentralising Aleph further. Doing so will bring the community closer to product development and shape Aleph’s growth into a fully-fledged ecosystem.

In the push towards greater decentralisation, Aleph is well-positioned to accelerate and capitalise on this shift, by delivering value to its customers in a meaningful way.

Make sure to subscribe now to not miss the next article.

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi

Please note: this was a sponsored article and I was remunerated in Aleph tokens. This did not affect my judgement in writing the article and Aleph had no input in the views that were expressed. This is not investment advice. Please do your own due diligence.