Live eCommerce: Infomercials are popular again!?!?

Livestream shopping shows are reskinned infomercials - will they be successful or a channel full of noise?

Welcome to all the new subscribers over the last month! You can read my last article on Aptos and Sui here.

Stay up to date with Superfluid by subscribing here:

Video, the focus for every social media app since TikTok took the world by storm in early 2020. Instagram launched Reels and Youtube launched Shorts. But amongst these large social media giants rose Whatnot, a live commerce app that raised a US$260M Series D round at a US$3.7 billion dollar valuation.

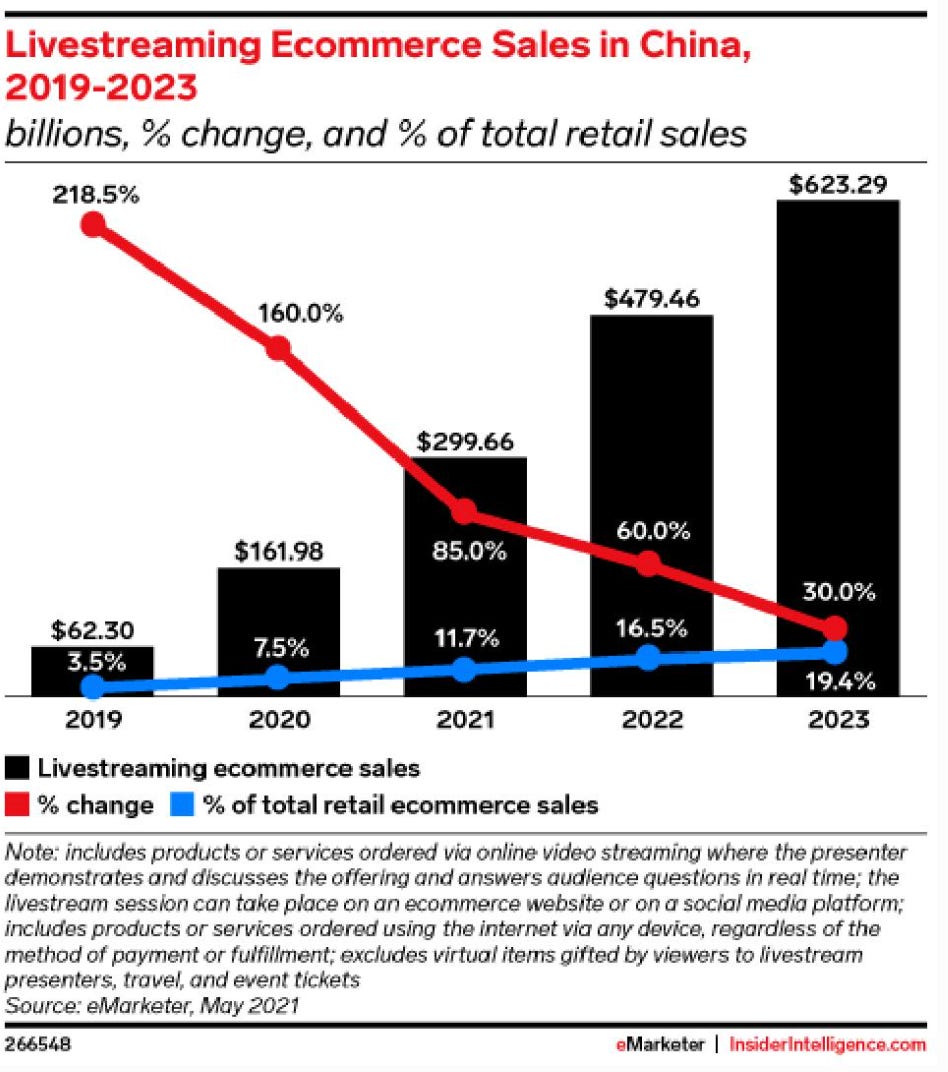

Playing on this trend is Livestream shopping. The new age infomercial. In 2021, live social shopping was a $300 billion market in China, at just under 12% of all retail sales and this year, it’s projected to grow 60% more. In the US, it’s expected to sit at $11 billion and grow to $25 billion by next year.

So, is live social shopping the next phase of eCommerce?

Livestream shopping has been a growing phenomenon in China since 2016, especially around the Singles day (China’s Black Friday equivalent) period. In 2019, live streaming contributed US$3 billion of sales on Singles day, in 2020, this figure jumped to US$6 billion spurred on by COVID lockdowns and by Alibaba’s concentrated effort to encourage more brands to constantly live stream during the day. Moreover, in a 2020 survey, 66% of Chinese consumers said they had bought products through a Livestream in the past 12 months indicating the importance of this channel in the eastern world.

Interestingly, live streams are not only run by influencers but also by brands themselves. In fact, in early 2020, brand run streams took off as brands employed their sales staff to start selling products online in an effort to make up for offline sales losses. Throughout this period, it allowed brands to have greater control over their brand image and positioning in the market rather than rely on influencers to effectively communicate this.

However, influencer-led streams are easily more entertaining and also convert more sales. Li Jiaqi, one of the largest live shopping streamers in China generated over US$1.7 billion in sales within a single 12-hour stream on Singles day in 2021. In another stream, he sold over 15,000 lipsticks in five minutes.

It’s clear that live shopping accelerates time to conversion. Streams are entertaining, informative and immersive. It streamlines the discovery and awareness process for consumers and provides them with an easy-to-use UX to instantly purchase products at will. Frequently, users are pushed to convert through limited-time offers.

Additionally, in a world where performance marketing costs have skyrocketed given more stringent privacy data policies and Apple’s iOS 14.5 update, brands are looking for differentiated channels in which to reach audiences. As a result, old-school channels such as radio slots, TV ads and billboards are back in play as marketers aim to exploit underpriced attention. In doing so, live shopping can provide brands with an outlet to not only convert customers but also improve brand awareness across a differentiated viewer base.

Live eCommerce isn’t for every brand or item. Whatnot started off focusing on Funko Pops. For the uninitiated, Funko Pops are cute vinyl figurines with large heads. They typically resemble a famous celebrity or character from a movie, TV show, book etc. Sounds gimmicky, but there is a huge market for Funko Pops, with over 8,000 different pops in existence and more coming. Since then, they’ve expanded their suite of offerings across 50+ categories but typically centred around collectibles that have an enthusiastic fan base. Given that Livestream shopping appeals best to impulse shoppers, items that lend themselves to being trialled with a lower price point, or are gimmicky and new are likely to succeed more.

Livestreams on Whatnot or other platforms are not too dissimilar from popular YouTube or TikTok content such as clothing hauls, makeup tutorials or product demos but with added interactivity. Regularly, streamers will weave interactive elements such as games, quizzes and giveaways to keep viewers engaged. Whatnot even has a giveaway feature built within the app that can be enabled once a stream starts. From here, the streamer just needs to announce and end the giveaway when they choose, and Whatnot randomly selects the winner.

As aforementioned, much of the Livestream shopping content is built on existing video content, so it’s no surprise that TikTok and Youtube have tried to get into the game with varying degrees of success. TikTok has seen a strong level of buying behaviour within China through its sister Douyin and launched TikTok Shop in the US and Europe as a trial. However, as of July 2022, they’ve paused plans to expand this to more geographies due to poor engagement and lacklustre sales.

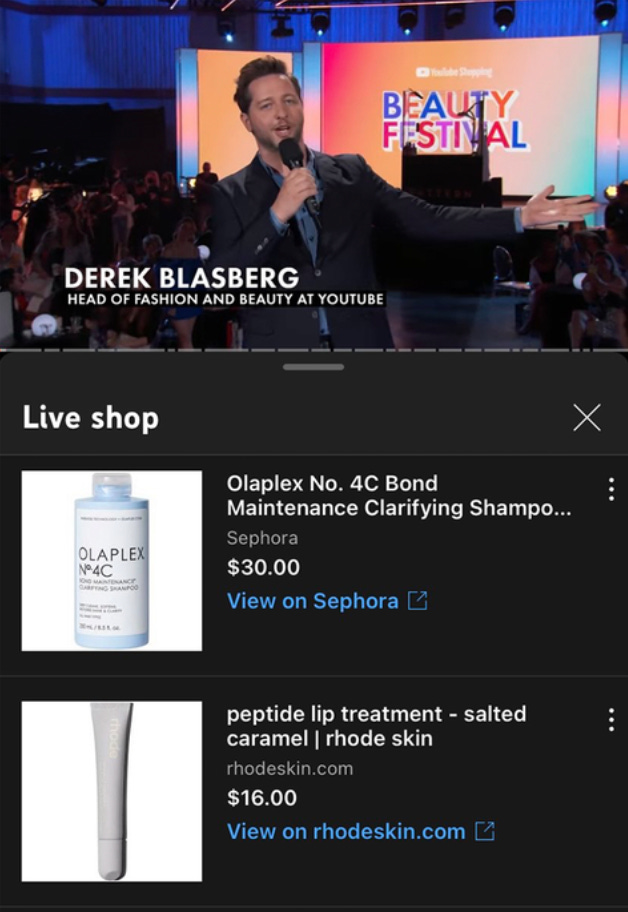

YouTube on the other hand has just entered the live commerce game through a partnership with Shopify. This partnership allows creators to connect their Shopify stores to their profiles and enable a checkout option so that viewers don’t need to leave YouTube to complete their purchases. Interestingly, with this implementation, it means that the onus is on creators to manage their own Shopify stores and spruik their own products, rather than promoting products from a variety of brands. Whilst creator stores are growing in popularity and merch is sought after, it’s unclear if such a limited implementation will be successful enough to expand to other shop types.

Approaching it from the other direction is Amazon, which quietly rolled out Amazon Live back in 2019. Whilst Amazon has previously engaged with creators in a passive manner through its Amazon Affiliates program, this seems to be an early push into collaborating and incentivising influencers to develop content for Amazon specifically. In order to incentivise creators to port their audiences across to its platform, Amazon has offered generous bonuses and hosted exclusive retreats to court influencers. However, whether the audience will actually follow is a lot harder given the existing proliferation of video-based platforms.

Realistically, it’s still unclear whether there is a market for live eCommerce platforms in the western world. For some, the amount of funding in the space, and the success live eCommerce has had in China makes it an almost inevitable phenomenon, but from my perspective, this is still largely up for debate. Different companies are approaching the market in different ways. Startups are typically going after it from a bottom-up perspective, looking to build a community around a certain vertical like Trading cards (Loupe), Funko Pops (Whatnot) and Luxury and vintage goods (ShopShops). Amazon is hoping its enormous catalogue of products will help it reach a different style of user base than it currently has. YouTube and TikTok effectively own the ‘discovery’ part of the shopping value chain and are hoping to really take advantage of this in order to create a seamless experience for the end user. At this stage, it seems like the startups are actually better poised to win market share early on and solidify their standing amongst the incumbents. It’ll be interesting to see if platforms like Whatnot will be able to continually expand their category range to incorporate other sectors such as healthcare, finance and more.

Taking a step back, whilst infomercials were big back in the 80s and 90s when the internet was still in its infancy, their relevance has largely been relegated to meme value (see below).

So why is live eCommerce any different?

One differentiator is that the presenter is typically an influencer of some sort rather than a professional presenter. But then, influencer marketing really stands out when the influencer is able to provide a genuine review or testimonial for the product or create appealing content without specifically relying on the product to create engagement and attention. So if the influencer is creating content on a platform that is wholly centred on driving conversions, then does that not cheapen the content produced and therefore lessen that person’s level of influence?

It’ll be interesting to track what engagement looks like on these platforms over time, and whether they are able to retain users and drive greater brand awareness and higher conversion rates for the brands. Additionally, live commerce solutions are solving a similar problem that’s being tackled by 1-click checkout solutions such as Bolt or Carted, which is basically reducing the time/clicks it takes to convert a buyer. Whilst those solutions still have a way to go, it’ll be interesting to see which product(s) end up winning in this space.

What do you think about live commerce? Do you think it will permeate through other geographies as it has in China or will it only be relevant for a few niche sectors? Let me know on Twitter!

P.S. This is kinda random, but whenever I think about infomercials, I think about this one about Flex Tape (the boat at the end is ridiculous). Enjoy!

Make sure to subscribe now to not miss the next article.

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi