Welcome to all the new subscribers over the last two weeks! You can read my last article on NFT Marketplaces here.

Stay up to date with Superfluid by subscribing here:

To some, the Fixed Income asset class is the most boring one of the lot. Yields are low, the market isn’t as volatile as equities and optimising for convexity and duration can get confusing. However, apply a bit of crypto to the mix and you get yield farming. New words for an old industry.

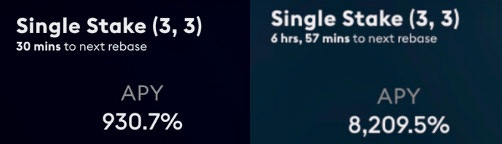

At the moment, it’s possible to access unbelievable yields in DeFi. 100% APYs are everywhere, with the opportunity to bank higher yields if you move into more exotics cryptocurrencies. But, DeFi yields move. A lot. One day the yields might be at 1000%, and then the next it’s at 150% or even lower.

Whilst anyone can access these yields, finding the next 1000% APY opportunity is time-consuming and hard. Knowing how to manage positions and knowing when to get out of a DeFi pool is tricky.

Enter Farming as a Service (FaaS).

Farming as a Service

Farming as a Service is an active Fixed Income fund looking to maximise yield above all. Rather than filling in a bunch of forms to gain access to the fund, all you need to do is buy the protocol’s token on a DEX. This also means you can trade in and out of the token easily without much hassle. This provides a significant advantage compared to a traditional fixed income fund which might only allow redemptions on a monthly basis.

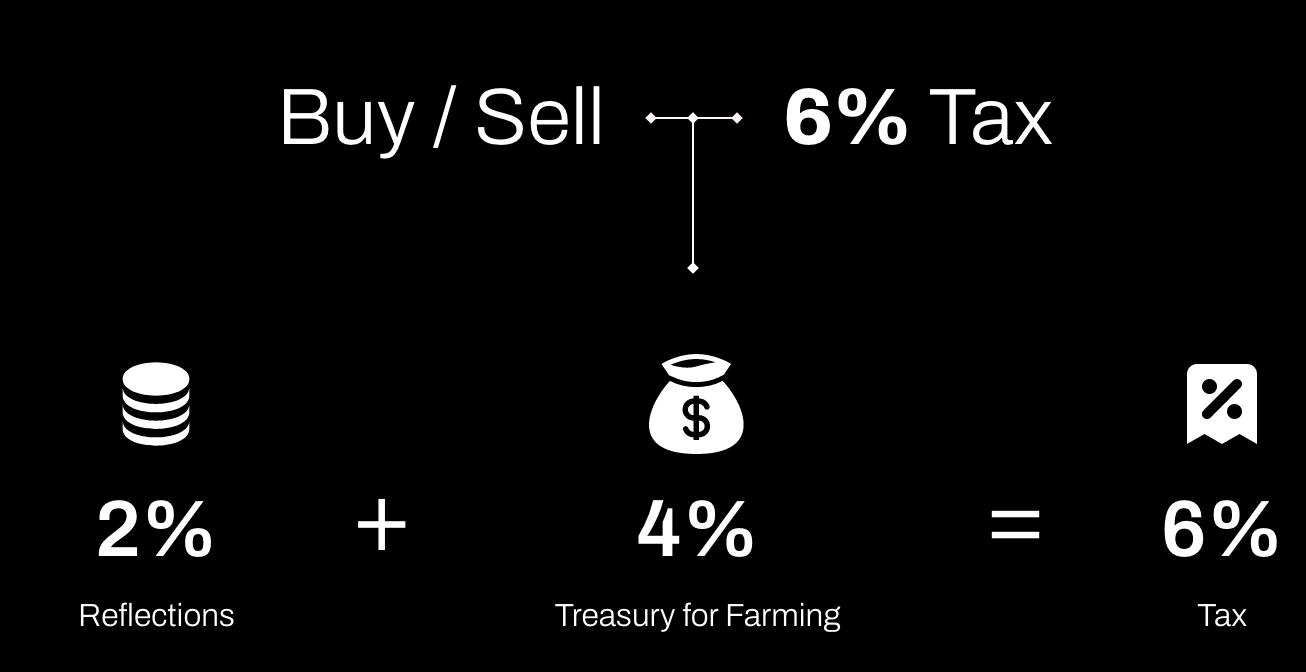

However, since you’re buying on Uniswap, the FaaS platform doesn’t see any of the ETH that you’ve exchanged. As such, in order to build the treasury, they place a tax on every buy and sell transaction. This is how they fill the treasury. In addition to this, some protocols also charge a reflections tax. Every time someone buys or sells the token, a percentage of it gets paid to the existing holders. This is to incentivise more people to hold and ensures a base level of liquidity for the protocol at the initial stage. As time goes on, this is likely to create a conflicted tension for holders and new entrants.

So now that we’ve lost x% to the reflections and entry tax, how do we actually make money with this? Hopefully, the team behind the FaaS is actually competent at maximising yields. This is done through farming, trading tokens and participating in early-stage rounds of new DeFi protocols. Effectively finding alpha in whatever way possible.

Unlike traditional Fixed Income instruments where the price rarely moves more than a few basis points, DeFi tokens can swing wildly. As a result, FaaS protocols need to actively monitor price appreciation in addition to movements in yield.

What makes a good FaaS?

Team

When thinking about which FaaS protocol to invest in, you want to dig into the team first. Understand who they are, what connections they have and their past experience. If they’re someone who writes prolifically(Tweet threads, Medium/Substack articles), seems genuine and are positive-sum, then it’s likely they have access to the hidden alpha. This is key to winning in crypto.

Performance/Strategy

With tradfi funds, it’s hard to get a look through on their holdings or even the exact portfolio strategy. You have to believe what the fund manager tells you and trust they do their job properly. With FaaS protocols, you get complete look through.

You can scrutinise the holdings, you can see what they’ve invested in and ensure that they are managing your funds appropriately. They also frequently tweet about their positions and thinking behind the trade.

It’s important to look at how frequently these protocols trade in and out of position, and how large their treasury is. The more these protocols trade, the trading costs (gas) increase meaning, there is a higher return threshold before the protocol returns a profit. Moreover, DeFi tokens can be thinly traded. If a FaaS protocol’s treasury is too large and it needs to make sizeable bets on each position, there may be significant slippage if the trade isn’t managed properly. This can also significantly impact performance.

Finally, it’s important to ensure performance is driven by active management, rather than collecting the reflections tax or simply holding ETH. It might be wise to use a basic benchmark of holding ETH, or even take the average of all FaaS protocol returns and compare that to the protocol that you’ve chosen. If there is consistent outperformance it could be worth investing in.

Marketcap to Treasury ratio

This is a metric that seems unique to FaaS funds but is actually quite similar to comparing the Net Asset Value to the market cap of a listed managed fund. Looking at this ratio allows you to measure if the protocol is under or overvalued. If the market cap is higher than the treasury value, then it is overvalued and vice versa. With this ratio, be mindful of dividends and distributions issued as that will obviously have effects on the price of the token as well as the size of the treasury.

Dividends

Now unlike a traditional fixed income fund which might redistribute profits on a monthly or quarterly basis, the protocol has control over when it chooses to distribute a dividend. They also have control over what token the dividend is paid out in. In most cases, it's ETH, which can be reinvested back into the protocol or withdrawn. In some cases, the native token is dispersed, but this can create downward sell pressure, making this option less attractive for a protocol.

Who’s leading the charge?

MultiChain Capital

MultiChain are the OGs of all FaaS protocols. They currently have ~US$29.4m in their wallet. MCC has also implemented a portable node solution that uses NFTs to create transferable nodes. This provides an alternative option for people to earn stable passive income, in addition to being able to ‘sell’ their position on secondary NFT marketplaces

Reimagined Finance

Reimagined Finance is the second largest in the space with a treasury of US$3.8m with 1657.71ETH distributed out to holders. Interestingly, ReFi is starting to branch out to other chains and recently added support for Binance Smart Chain. For holders on this chain, the rewards are paid out in BNB.

Exponential Capital

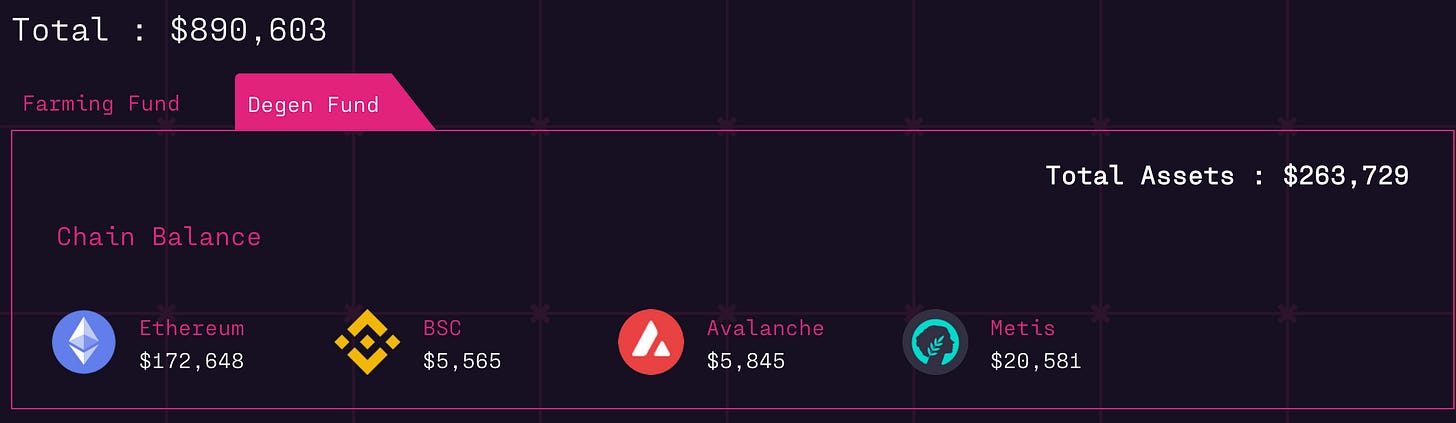

Exponential Capital has taken a different, two-prong approach to FaaS. At the moment, they have a treasury of US$0.9m, split across two buckets, namely a Farming Fund and a Degen Fund. As a result, Exponential Capital functions more like a discretionary Hedge Fund rather than a yield focused Fixed Income fund in that, the Degen Fund looks to invest 20% of the portfolio in very high-risk assets such as memecoins, and also other small-cap coins. This approach could prove fruitful, but as the fund grows in size, it will become harder to exploit these undervalued opportunities in a meaningful way.

Scary Chain Capital

Scary Chain Capital (SCC) currently has a treasury of $1.1m and are also taking a different approach to FaaS. DeFi 2.0 saw a wave of new bonding mechanisms. This meant that users were able to create liquidity pool (LP) tokens (i.e. stake tokens) and exchange this for discounted tokens of another protocol. This is powerful as it allowed protocols to bootstrap their liquidity at the start, whilst also attracting loyal liquidity providers by providing a double incentive.

In order to fill their treasury, SCC offered this to their own customers. Simply exchange FTM-SCC (Fantom) or USDC for discounted SCC. By doing this, SCC makes it harder for people to sell out of their SCC position as they need to unravel two positions to do so and deal with the selling tax that all FaaS protocols place on their token. This definitely gives off some Ponzi vibes, but it’s unclear how this will evolve in the future.

JPEG Morgan

JPEG Morgan is the new kid on the block with a treasury of US$85k. As the name suggests, they are more than just a generic FaaS protocol, opting to add NFTs to the mix. Like SCC, the protocol looks more like a hedge fund than a pure FaaS play, with three different verticals to its strategy: Yield Farming, Nodes and NFT trading. At the moment it’s still early days, but it’s exciting to see new strategies being tested out to provide investors with diversity.

Where to from here?

So we’ve seen pure yield chasing protocols and protocols with crossover strategies all attempt to maximise gains for their investors. Whilst at the start of this piece, I remarked that FaaS protocols are basically Web3’s version of a Fixed Income fund, the creativity of the space comes through in protocols such as JPEG Morgan or Scary Chain Capital where it looks more like a discretionary hedge fund.

Given the nascency of the space, it’s hard to see where the long-term winner lies. Investors will naturally gravitate to whichever protocol suits their individual risk profile best. If you were to take a portfolio approach, currently sizing your allocation to different fund strategies could be one way of getting comfortable with the space, understanding the mechanics at work and diversifying your exposure to individual protocols.

In the future, it’s likely we’ll see whackier iterations of these protocols, making use of the flexibilities that DeFi affords us.

Make sure to subscribe now to not miss the next article.

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi