NFTs x DeFi: The Next Big Crypto Evolution

Creating liquidity for NFTs unlocks a large amount of value for holders and might ignite the next cycle

Welcome to all the new subscribers over the last month! You can read my last article on Lens Protocol here.

Stay up to date with Superfluid by subscribing here:

It’s meant to be a bear market but it’s free mint szn in NFT land with popular collections like Goblintown, The Saudis and Killabears going to the moon 🚀.

As NFT investors cope with the bear market with more degen behaviour, other builders are focused on creating mechanisms to make the NFT market more liquid and efficient, and allow NFT collectors to make their assets more productive.

NFTs are inherently illiquid assets with no efficient pricing curve. This poses two problems:

Aside from the initial mint price of an NFTs, pricing is largely determined by hype, rarity and the expected value of future utility from holding the NFT. This results in heavily subjective pricing and opens the market up to frequent arbitrage opportunities which means the market is inefficient

NFTs are largely unproductive assets. This means that it can be tricky to earn a yield from holding an NFT unless there is an associated token, and depending on the value of an NFT, can result in a large amount of capital locked away.

In true crypto fashion, these issues get solved to an extent if we just combine a few different pieces of the crypto puzzle. By mixing DeFi elements with NFTs, a few unique protocols are pioneering the next wave of financial engineering and market efficiency.

Trading and Pricing NFTs Optimally

So how do you price an NFT correctly? At the moment, it’s based on a bit of guesswork, understanding the level of hype for a certain project and observing current trading activity for a specific collection.

There are a few ways to solve this. To date, the most popular way has been fractionalising NFTs using platforms such as NFTX, Unic.ly and Fractional.art.

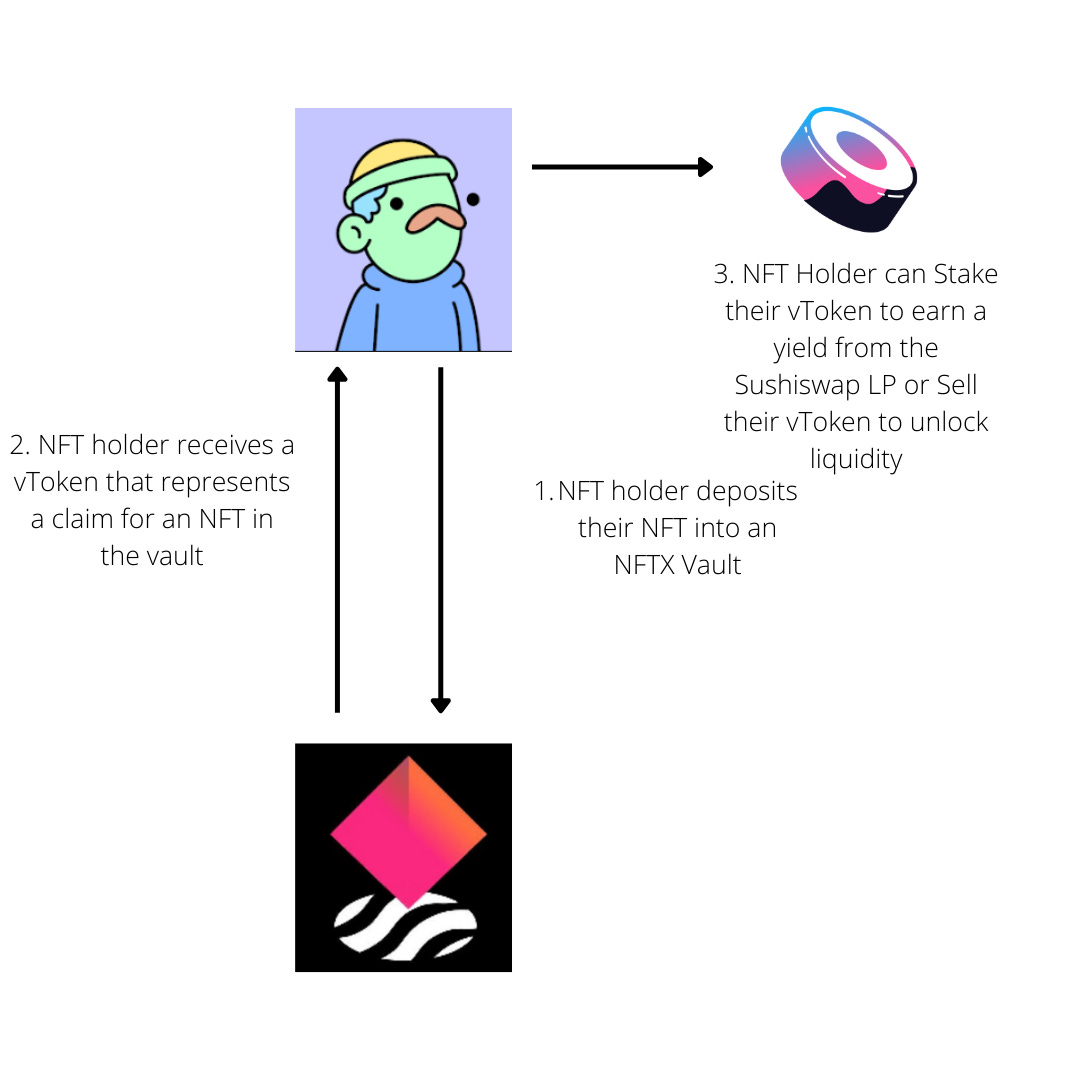

Each platform operates slightly differently, for example for NFTX:

The NFT holder deposits their NFT into a vault that contains other NFTs from the same collection

In exchange, the smart contract issues a token that represents a 1:1 claim of an NFT from the vault

This token can then be used to earn a yearn on Sushiswap or can be sold and the proceeds can be used for something else.

With NFTX in particular, the vault is expected to contain base level NFTs (i.e. NFTs valued at the floor price) and so when the holder redeems their NFT they will be given a random NFT from the vault which may or may not be the same as what was deposited originally. Hence this model works well for floor NFTs from blue-chip collections, but not NFTs that have a rare trait.

Moreover, this method is imperfect as it foregoes valuing many of the benefits of holding the NFT. Beyond speculative value, NFTs grant the holder the ability to access gated communities and to receive both real and virtual utility. By fractionalising/tokenising an NFT, neither the original owner of the NFT, nor the holders of the fractionalised token are able to claim any associated utility.

Other protocols like Sudoswap are taking a DeFi centric approach through building NFT specific Automated Market Makers (AMMs). AMMs led the rise of DeFi through protocols such as Uniswap and Sushiswap which were built as a high-performance alternative to centralised exchanges. In that same vein, SudoSwap hope to remove the need for a centralised NFT order book hosted by platforms such as OpenSea and Rarible.

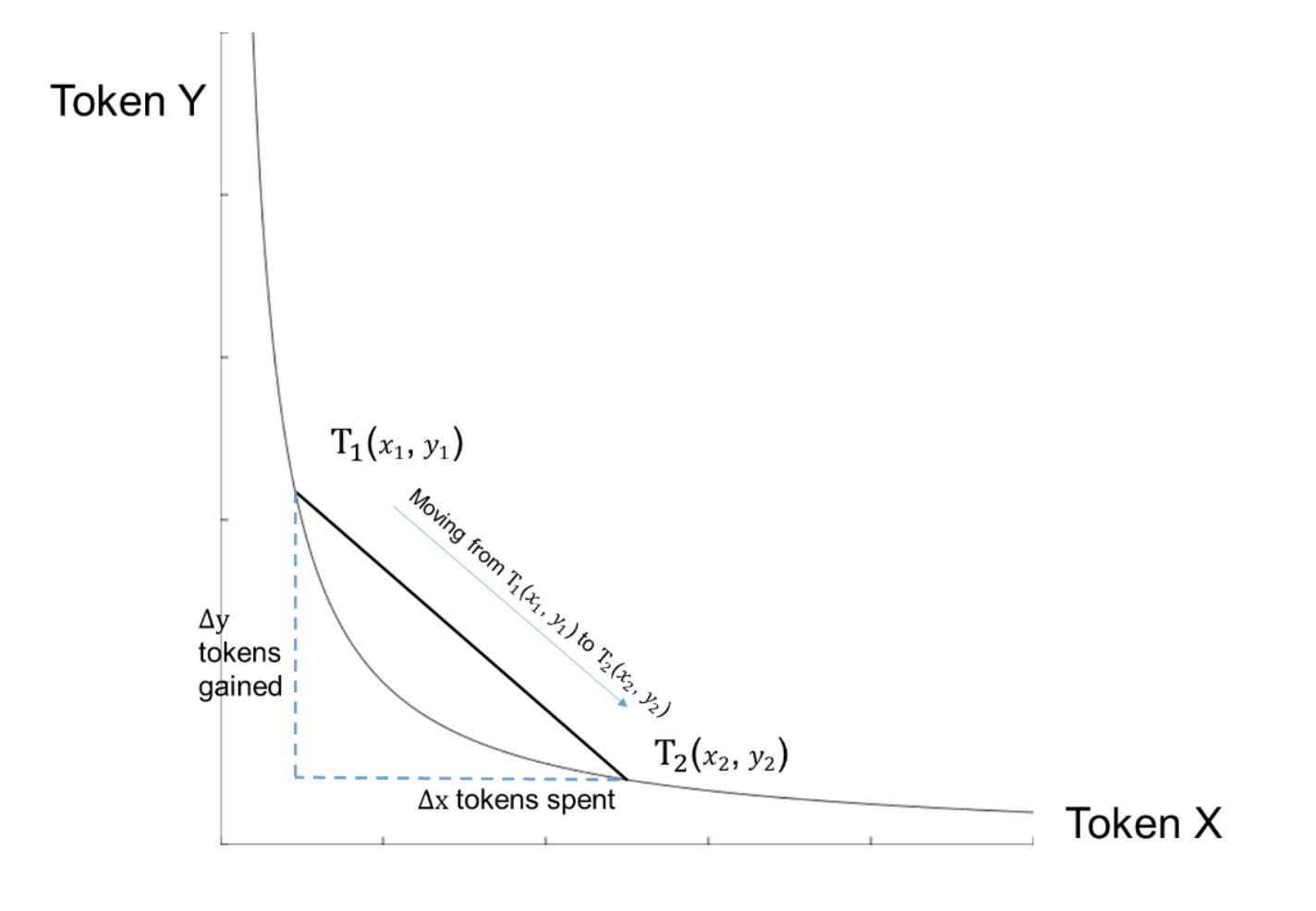

Standard DeFi AMMs usually work under an XYK model. This means that in a given liquidity pool, there are x coins of token X and y coins of token Y that multiply to give constant k (i.e., xy = k). Every time someone buys or sells coins, this shifts the price along a set curve to ensure that the xy = k condition is held true (see diagram below). However, this is unsuitable for NFTs, as people prefer trading whole NFTs meaning finding liquidity is hard and the supply for each NFT collection is significantly smaller compared to a normal token.

In a bid to solve this, Sudoswap gives users the option to create their own NFT pools and determine their own pricing curves. This means that a user could create any of the following pools:

Buy-Only - This pool contains ETH and provides quotes for the pool to buy NFTs

Sell-only - This pool contains NFTs and provides quotes to sell these NFTs

Buy and Sell - This pool provides both buy and sell quotes

Within each of these pools, the original pool creator is able to stipulate which pricing curve is used to determine the quotes provided.

Constant - The quotes are always the same regardless of trading volume

Linear - Increases or decreases the quote linearly with each buy or sell

Exponential - Increases or decreases the quote by a pre-determined percentage with each buy or sell

By employing these customisations, SudoSwap can ensure that users will be able to get immediate quotes on either the buy or the sell side, with the hopes of reducing slippage. In addition, single-sided pools (i.e. buy or sell only) can serve as automated trading strategies to either dollar cost average in or out of a large NFT position, e.g., If you owned 10+ NFTs from a single collection, you could set the pool to sell each one at a linearly increasing higher price and vice versa, you could purchase 10+ NFTs at a linearly decreasing price to build a large position in a collection.

Quite controversially however, is that SudoSwap has made the move to cut out royalties for NFTs traded on their platform. Whilst SudoSwap’s base trading fee is 0.5% relative to OpenSea’s 2.5%, as royalties are determined off-chain through an exchange SudoSwap do not currently have functionality to incorporate this into each transaction. Obviously, this is a step backwards for the creator community and NFTs in general as one of the key benefits of using NFTs for digital art is the ability to receive royalties in perpetuity. To bring this on-chain, token standards need to be updated to include royalty functions within the smart contract, but for now, it’s uncertain if and when this update will be made.

Pricing NFTs as Collateral

Blue chip NFTs cost a lot of money. An easy assumption to make is that for most holders who minted or bought into the project early, they plan to never sell given the emotional and sentimental attachment NFTs can create. As such, this can result in a large amount of their net wealth tied to a single asset unable to be used for anything else.

In order to alleviate this problem, NFT based lending platforms have popped up to allow NFT investors use their illiquid NFTs as collateral. At the moment platforms exist to offer direct Peer-to-Peer and Protocol lending. P2P lending is typically inefficiently priced as the valuation of the NFT is left in the heads of the lender and their risk appetite. On the protocol side, there are two different valuation methods.

Oracle Based Pricing - whilst this sounds complicated, protocols using this methodology simply source the latest floor price, or average of X number of sales over a certain time frame in order to estimate the price for an NFT. Some protocols might build on top of this to value a collection’s unique traits individually and create custom valuation models for each collection. This approach is obviously slower and not scalable and so protocols that adopt this approach only list blue chip projects.

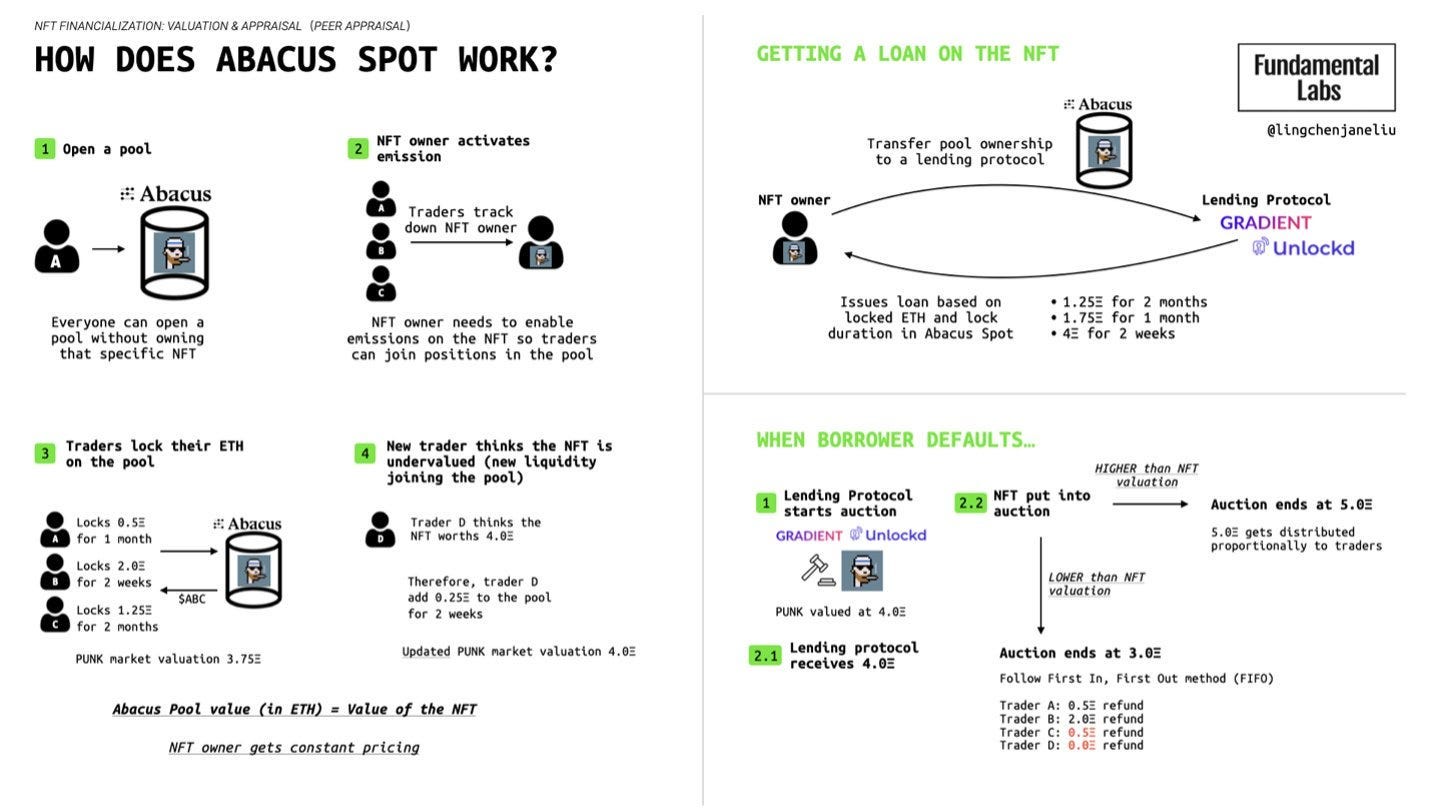

Optimistic Proof of Stake Pricing - pioneered by the Abacus protocol, Optimistic PoS combines different principles from optimistic rollups and proof of stake consensus mechanisms. For OPoS, anyone can create an NFT pool and pledge their NFT. Other participants are able to lock their ETH to the pool for preset periods (e.g. 2 weeks, 1 month etc) in exchange for yield rewards. The total amount of locked ETH represents the market valuation for the NFT. If participants think the NFT is undervalued, then they can continue to lock up their ETH.

Yield rewards are given in exchange for validating the price and guaranteeing the integrity of the pool’s valuation for the NFT. The owner of the NFT can use the pool’s valuation as collateral to borrow funds. Lending protocols can issue loans based on the locked ETH within the pool and the duration of the locks.

Pools can be closed in two ways 1) the borrower defaults and the NFT is auctioned. The lending protocol immediately receives the locked ETH, and the participants who locked their ETH will receive proceeds from the auction. If the auction ends at an amount higher than what was locked, this gets distributed proportionally to all pool participants. If it ends lower, then distributions are made in a First In First Out method. I.e., the first person to lock their ETH is made whole first and so on. This penalises those who enter the pool last as it is deemed that these participants overvalued the NFT and as a result lose their capital. 2) If the pool owner believes that the pool has overvalued the NFT, they can exchange the pool liquidity for the auction revenue. Auction revenue gets split out in the same way as above (i.e. FIFO).

Credit: @lingchenjaneliu

Observing how accurately OPoS determines valuations will be interesting given it still largely relies on human judgement. Participants will likely use pricing oracles and their intuition around the value of certain traits to determine the valuation for an NFT. However, the ability to potentially arbitrage valuations could make the market more efficient. Moreover, Machine Learning algorithms are starting to make an appearance through protocols such as Upshot. Whilst their initial results seem to be fairly accurate, this needs to be proved across a wider range of collections with varied trading volumes and data.

Sooooo, wen bull market?

It’s clear from the advent of SudoSwap and Abacus’ valuation methodology that builders are willing to test and iterate on different, non-traditional models of providing liquidity and generating valuations for an illiquid market. Ideally, this helps unlock unproductive capital which may then be recycled back into the ecosystem in some form.

The products that win in this space will be those that can onboard users easily, without overcomplicating the mechanics of the protocol. For the most part, many NFT investors/speculators/collectors are intimidated by DeFi. The complex mechanics that many of the existing protocols employ can be off-putting given the recent troubles with centralised institutions. As a result, clear communications, transparency around potential risks and intuitive UI/UX is key to onboarding the normal user (i.e., users who are not NFT whales). I hope that whilst the aforementioned protocols pave the way for innovative approaches to unlocking further value in NFTs, subsequent protocols can build on top of this and provide a 10x improvement in the usability of their platforms.

Make sure to subscribe now to not miss the next article.

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi