On Balancing Profitability and Growth

Startups have always been about growth, but now VCs are claiming they need to be profitable - what gives??

Welcome to all the new subscribers that have joined us over the last week! If you haven’t already, you should check out my last article here:

If you like what you read, please subscribe to Superfluid here:

In 2021, the VC war cry was undeniably "Growth, Growth, Growth".

In 2023, it's "Profits, Profits, Profits".

In my last article, we talked about shifting benchmarks and expectations from VCs. The switch from a focus on growth to profitability is one that basically every VC has asked their portfolio companies to do in 2023.

And, it's for good reason. Growing 500% year on year doesn't mean your business is good if you're also burning a ridiculous amount of money to achieve that. A few people in the ecosystem have claimed that this was just natural. The incentives were set such that startups were rewarded for burning lots of money and VCs were also motivated to deploy lots of money. Whilst that probably is true, it seems like a futile argument if the goal for founders is to build a stellar business, that has a large impact on their sector and for VCs to return lots of capital to their LPs.

You don't need to burn lots of money to achieve either of these outcomes. With a bit of forethought from both sides, the whiplash between pushing for growth and now profitability wouldn't be necessary. Growth and profitability do not need to be mutually exclusive.

The Rule of 40

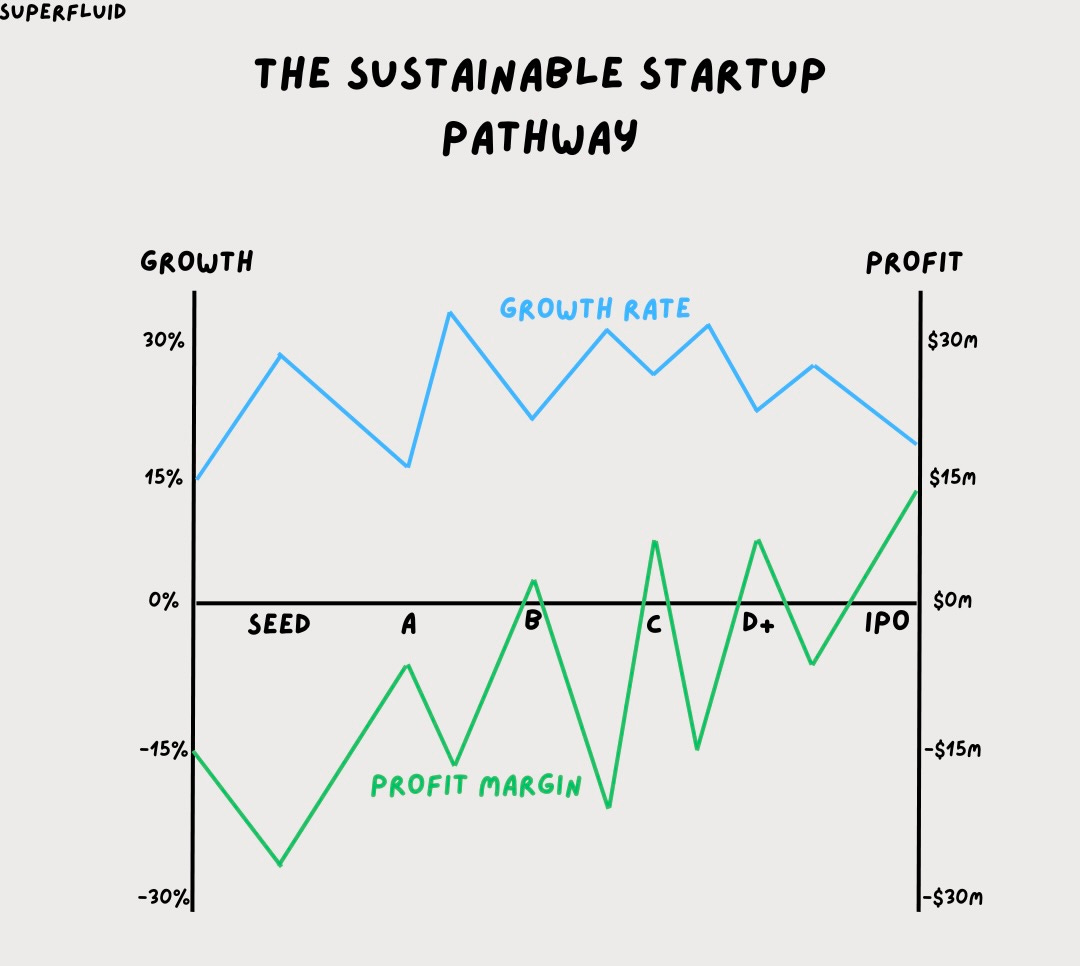

A great business is defined by two things: 1) its profit margin, and 2) its growth rate.

Popularised by Brad Feld, the rule of 40 balances your revenue growth rate with your operating profit margin and is a good way to determine whether your business is great.

Written as a formula, it looks like this:

In this instance, the 40 is more of a guideline or target for SaaS businesses to hit. As an example, if you grew 20% per year and had 20% operating margins, you would hit the benchmark. Or if you were growing 50% per year and had -10% operating margins, you also hit the benchmark.

Whilst not entirely scientific in its derivation, the rule of 40 adequately establishes a relationship between profitability and growth. Whilst some VCs might argue otherwise, I believe that if you're looking to build a strong, recurring revenue business, there’s no reason to have a lopsided growth strategy without having any constraints on how much revenue and subsequently profits that strategy is able to produce.

Instead, consider a strategy that moves in a stepwise fashion. Invest some money to fuel growth, garner customer love, feedback and further PMF, bank the revenue and funnel that back into growth. As logical as it sounds, so many companies, even now, rely on venture capital to fund their growth, rather than building the fundamentals of their business.

Profitability = Optionality

The standard operating principle for venture-backed businesses seems to be to burn capital to chase growth. That certainly is required at the early stage when a product needs to be built and a scalable customer acquisition strategy needs to be developed, but by no means must it apply through all stages of the lifecycle.

Reaching profitability or a state of 'default alive' is by far the best lever you can pull in your business. If you're able to reach a state of profitability within a few years, then you're able to reinvest the profits back into the business and continue growing at high growth rates without needing to burn capital and raise further money.

With a north star metric of actually making a profit, the internal culture of the organisation also benefits heavily. Being incredibly disciplined around needing to make a profit every year forces the team to think creatively about how they allocate capital and time internally. When mapping out the org structure, you'll think twice about whether you need to hire more people. Sales and marketing conversations will be more creative with a bias towards low-cost ways of achieving virality.

If a business doesn't need to make money to grow, then a state of excess becomes the default. Excessive hiring and over-engineering become the norm and hard decisions are simply sidestepped because you don't need to deal with them. To ensure you have a high-quality team pulling in the same direction, having a profitable-focused mindset is key.

How do you decide what to do?

So you've spent a year chasing growth, and now been told to start banking profits, what do you actually do and how do you navigate this?

Understand where you have leverage in your business

Figuring out your true competitive advantage is key. Whether that's through superior unit economics, hyper-efficient customer acquisition strategy, in-house talent or something else entirely, you need to take a ruthless approach towards actually determining what makes your business great.

Previously, you might have given yourself some soft platitudes about how you've just hired the ‘best’ growth marketer, or that your customer acquisition strategy is just ‘starting to click and you need a few more months of data and testing’.

It's too late for all of that. In this environment, platitudes don't make money and you won't be able to raise future rounds of funding on niceties. In many cases, most businesses aren't good, and will not have much going for them. If there's nothing working in your business, you need to acknowledge that. You need to be able to distinguish between what's just mid and what's actually stellar.

Understand the leakages in your business

Again, you need to be ruthless in diagnosing what is ruining your business. Churn higher than benchmarks - call that out. Lots of pushback in pricing, or excessive discounting required to convert customers - note that down. Being easy on yourself and your business isn't going to help. If you think something isn't functioning the way it should, then call it out. You can only diagnose and solve problems that are visible to you.

Understand the benchmarks required for you to raise your next round or if you even want to be on the VC pathway

You've already taken one (or maybe more) rounds of funding from VCs and other investors. Future business decisions are largely predicated on whether you want to take on more rounds of funding.

a. Getting off the VC pathway

If you don't want to go down the VC pathway, that's more than okay. Your VC will probably thank you for making that decision - they now have clarity on the future of your business. From here, they'll likely rethink how involved they are with your business, and more often than not, pull back from being involved. That doesn't indicate that you're not meaningful, it just means the VC can spend time helping other companies prepare for their next fundraise.

Once you've chosen this pathway, you need to understand the financials of your business intimately. You need to be able to work out how you get to profitability and stay there. This involves working out how much of your cost base you need to decrease, the impact of that decrease on servicing revenue and then how much new revenue you need to bring in to achieve profitability and stay cash flow positive.

b. Staying on the VC pathway

If you want to stay on the VC pathway, you've got to understand the goals and benchmarks you need to hit. Talk through this with your VC, and see what they think. They should have an appropriate pulse on the market with regard to what future investors would want and the type of story that needs to be told to excite these investors.

On your end, ideally, you already have a list of next-round investors. If not, start compiling one, and reach out to them. You're not looking for a meeting here, but getting their take on what the market looks like from their perspective and what benchmarks they use on their startups. It's in their best interests to give you an accurate number, after all, you could be future deal flow for them.

Once you've got a few data points, reverse engineer your way towards hitting them. Different VCs will focus on different metrics, so you won't be able to optimise everything, but if you can optimise for metrics such as new revenue growth, churn, net revenue retention and your burn multiple, that will put you in a solid place to be able to have serious discussions with VCs.

As I covered in my last article, benchmarks are fluid in this market environment, so always make sure you have guidelines that have been sourced in the last ~3-6 months to make sure you're on track.

Further Considerations for Founders

Going through the process above requires input from your team. Without your team, your startup would not be where it is today, so make sure that they are involved and aware of the changes that could affect their livelihood. In stressed times, focus and transparency are key. Being able to ask hard questions, maintain a realistic outlook and have open conversations with your team will help them trust you more. If you take a pragmatic approach towards the future game plan and celebrate small wins along the way, you’ll be able to manage expectations but also motivate your employees to persevere and hustle harder.

Additionally, over the last few years, startups have used VC funding as their lifeblood. In reality, it's a tool that can be used to significantly derisk parts of your business. Whether that's building product, acquiring customers or something else entirely, it is still a tool. It isn't a substitute for strong business fundamentals, or having a robust business model. I hope the biggest learning founders have out of this experience is that they should not be reliant on external funding sources to sustain their business.

This applies across all market cycles. VC funding is by no means guaranteed, regardless of how much revenue you are making. I've seen multiple businesses try to raise money in the middle of 2021 and fail, despite having a few million dollars in revenue and decent unit economics. Nothing is guaranteed so don't stake your business on your ability to raise further capital.

In saying this, as a VC, we’re looking for pragmatic founders who are able to show their ability to learn fast and move quickly. If you’ve made mistakes in the past with managing runway, that’s fine, as long as you can demonstrate how you’ve rectified them and learnt what not to do. As VCs, we understand and expect startups to not be perfect and to need some assistance at the early stages.

Make sure to subscribe now to not miss the next article.

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi

Nice one Abhi!