Patience, Patience, Patience

Venture is a long term game, why are we obsessed with short term gains?

Welcome to all the new subscribers that have joined us over the last few weeks! If you haven’t already, you can read my last article on Blur vs. OpenSea here.

Stay up to date with Superfluid by subscribing here:

Dealing with change and uncertainty is unnatural. Whilst people know and understand that things don’t always go how you would expect when it comes to actually facing a change in conditions people lose their minds.

Whilst I’ve only been in VC for ~2 years, I’ve seen companies in various levels of distress. From nearly missing payroll runs to going through year-long fundraising journeys, it’s fascinating to see how that impacts the people that I work with. You’d hope that working in VC, people would be more comfortable with uncertainty. After all, we’re only expecting 1 huge outlier to make up for the other losses.

But naturally, no one wants to take a loss, and when a company is facing a precipitating drop, I’ve seen highly capable people clam up and freak out.

It’s not a contrarian view that change is hard. But in today’s society, when people expect quick changes or to see metrics always move ‘up and to the right’, I wanted to write an article on placing all of this into perspective using a framework that I recently read about.

What does a technological revolution look like?

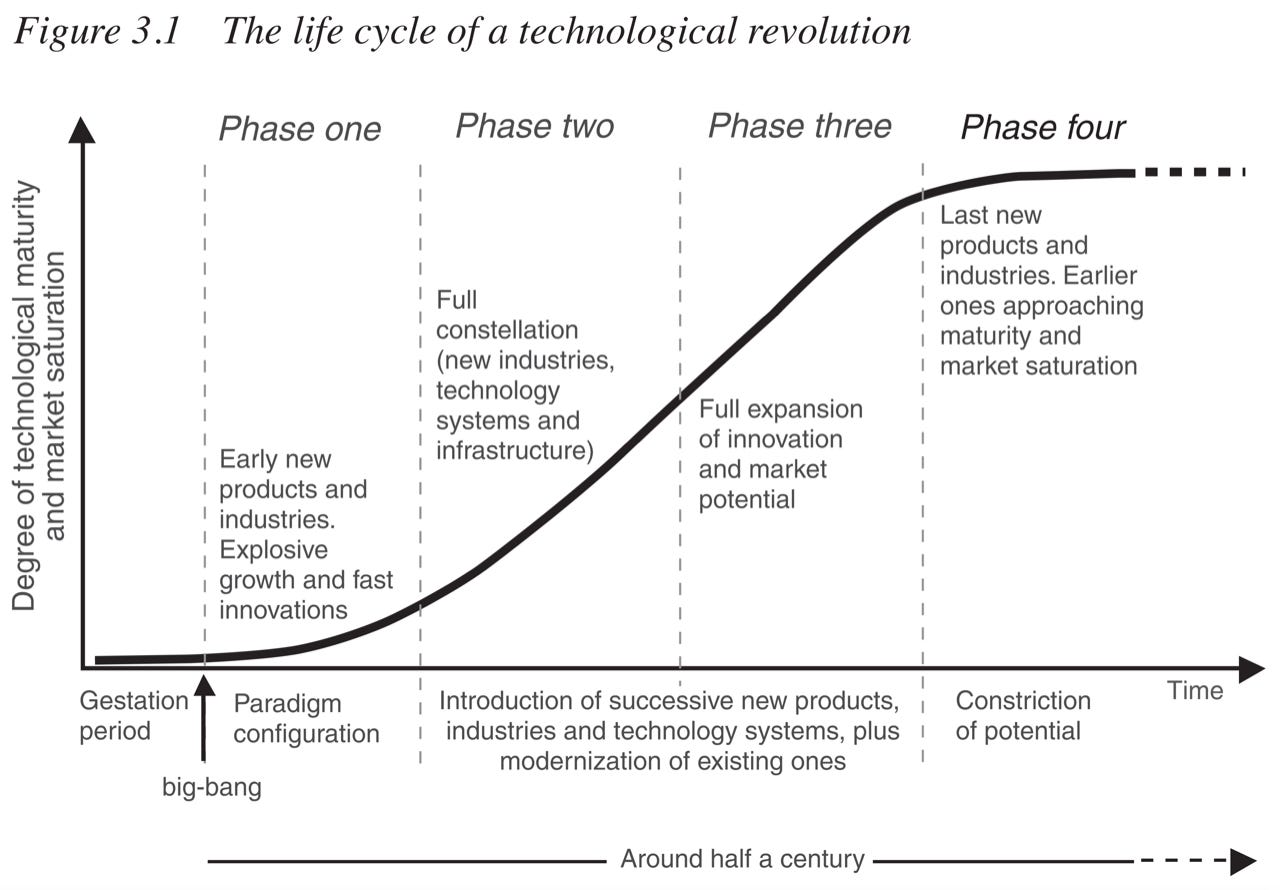

Carlota Perez, a famous economist, provides us with a useful framework for what a technological revolution looks like.

Using the diagram above, we can split the full cycle into two distinct periods: the installation period (phases one and two) and the deployment period (phases three and four).

In the installation period, this is when new technologies (e.g., crypto) make an explosive entrance into society and captures widespread imagination and showcases future promise. Through this period, the new paradigm is pitted up against the old incumbents and must overcome the ensuing resistance.

In the deployment period, this new technology becomes embedded within daily life and the whole economy is adjusted to accommodate this new paradigm.

Realistically, none of this information is that revolutionary. This is just what basic disruption is. But, it is important to understand the timeframes which this encompasses and also the link towards financial cycles.

As we saw with crypto and the advent of web3, financial incentives are a powerful force in propagating new technology and to some extent overstating the efficacy of such technology. As Perez writes:

“The ostentation of success pushes the logic of the new paradigm to the fore and makes it into the contemporary ideal of vitality and dynamism. It also contributes to institutional change, at least concerning the ‘destruction’ half of creative destruction.”

However, this is immediately followed by a recession, bringing the financial markets back down to reality. But more importantly, the continuous negative atmosphere surrounding society creates mounting social pressure and fosters the conditions for substantial institutional upheaval. Slowly new products are adopted, and new ways of work proliferate through society leading to a ‘Golden Age’.

Whilst acknowledging the different phases is incredibly important, it’s even more crucial to recognise how long this full cycle takes to complete.

50 years.

Roughly 50 years from start to finish to fully proliferate through society and reach a significant point of saturation. Realistically, starting in the 1970s, we’ve probably only finished one of these revolutions that involve modern computing technology (i.e., the information age). And so to the people who’ve written off crypto as the next paradigm or who decree AI as the next bubble - you could be completely right, but it’s impossible to truly know at this current moment.

Applying this to 2023….

It’s an interesting thought experiment to toy around with whether this framework can be shrunk down to maybe 20 or 30 years. The economy is certainly more productive than ever before and it’s a lot easier to spin up new businesses.

In today’s society, we’re used to things coming quickly. Our attention spans are shorter than ever before and our expectations are certainly higher. And so given each revolution takes time, it’s almost no surprise that we jump from one trend to the next almost overnight.

From crypto to AI, the entire venture ecosystem has seemingly jumped ship from one buzzword-heavy topic to another. And there’s already another potential jump forming with a heavy focus on ClimateTech startups (for good reason) starting to permeate through venture firms.

A lot of people think this is stupid.

In reality, this is just following Perez’s framework. Crypto has already gone through multiple financial frenzies. Maybe there are more to come.

The latest AI revolution started in 2017 but has been simmering away for much longer. It might be in its financial frenzy at the moment, with VCs ready to back anything that has ‘.ai’ in its URL

And with ClimateTech, there was a huge financial frenzy for at least a decade and then a subsequent trough. Now it’s back again and maybe now is the right time for it to entire its ‘Golden Age’. We’re seeing more proactive government policy and stronger institutional incentives that could lead to the rapid adoption of tech that the world desperately needs.

No one can predict the future, least of all VCs. It’s not an entirely bad thing that new technology takes the world by storm one day, and subsides the next. It allows people to dream and imagine future possibilities and motivates people to chase after their perfect world.

Moreover, there is a strong chance that for certain segments of the economy, we are in the maturation phase.

With abundant competition in the market, it’s certainly harder for SaaS businesses to gain real market adoption than ever before. This is why we see large raises earlier in a company’s journey. VCs by default assume that with 100s of millions of dollars, distribution solves itself but this couldn’t be further from the truth.

A few weeks ago, I wrote about Blur and OpenSea. OpenSea has raised at least 2-3x more than Blur, but due to an inferior product has lost half its market share. This can happen in any market.

My two key takeaways from Perez’s framework are:

For Founders: You actually have more time than you think to institute large-scale disruptions. It’s better to take an informed and iterative approach to product development and GTM especially at Pre-Seed and Seed. Every technological revolution takes time so be patient and trust the process.

For Investors: Chucking money at category creators can work, but more often than not leads to an incredibly futile battle. Just look at the grocery delivery startup mania that happened in 2020 and 2021. Where are they now? Again, for investors, be patient, and if you decide to back a startup in a buzzy space, deploy your money sensibly. You don’t want to be overleveraged in the wrong market cycle.

Make sure to subscribe now to not miss the next article.

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi