Pivots Don't Need to be Stressful

Pivoting well is crucial if you want to succeed

Welcome to all the new subscribers that have joined us over the last week! If you haven’t already, you should check out my last article here:

If you like what you read, please subscribe to Superfluid here:

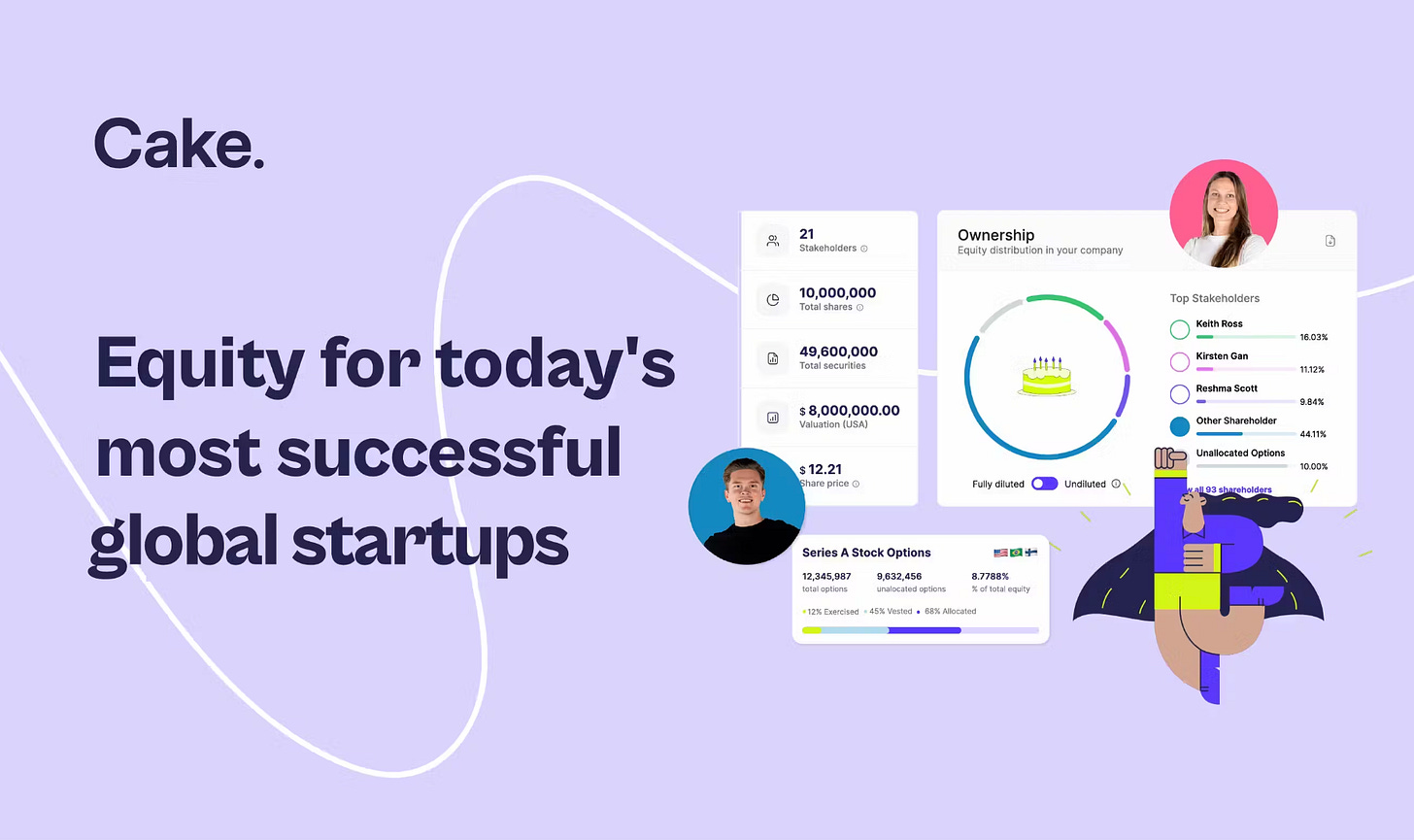

Today’s Superfluid is brought to you by Cake Equity!

Cap tables are annoying.

They’re clunky, confusing and usually incorrect.

Fortunately, Cake Equity has solved this for investors, founders and remote teams globally.

With Cake, it’s easy to issue and manage stock options and get an audit-proof 409A valuation fast.

If you aren’t using Cake to manage your cap table, you’re missing out. Check out Cake on Product Hunt today!

Growing up as an immigrant, my parents always pushed me to work hard and never stop trying even if it seemed like things weren't going to get better. Being persistent is an important trait to have as a human, but is also an easy fallacy to fall into.

Usually, creative people are clear case studies of this. Many artists, musicians, writers or YouTubers will grind away for years on their craft, all in the hopes of making it big. They know it's a tough journey, and that the odds are stacked against them, but have the belief that persistence will get them to where they want to go.

For some people, this will work out. After recording 100 songs, the 101st single might hit the charts, and push them to stardom. But the likelihood of that is so incredibly low.

I've met founders who are quite similar. They'll have an idea or a thesis that they unequivocally believe in. They'll execute this vision and spend years just plodding away, without much to show for it. Every time I talk to them, it feels like deja vu.

Without fail the following lines are said:

"Pipeline has never been better!"

"We're just one meeting away from getting them onboard."

"Our product is 100x better than [insert competitor] here."

I don't blame any founder for thinking or saying any of the above. Building a business is hard. If you didn't have illogical confidence in your business, then what's the point of running a startup?

But hearing these lines repeated like clockwork is also incredibly sad. Hearing clearly talented founders, convince themselves into thinking things will change if they just kept going is hard to hear. Especially when you've seen the same story play out a hundred times before.

Now, don't get me wrong. Persistence is important, especially in a world where there are a hundred things going on at any given time, and shiny objects are easier to spot and chase. However, I think realistic persistence is what separates a great founder from an ordinary one. Knowing when to be persistent and to go against the grain is just as important as knowing when to be flexible and malleable.

Pentagonal Startups

In your startup, there are 5 things that truly matter:

The People: This includes both founders and employees

The Market Dynamics: External forces that are either pushing your startup forward or holding it back

The Product: This is pretty obvious.

The Go-To-Market Strategy: How you actually find your customers

The Business Model: How you make $$$

If a startup is deficient in any one of these factors it will struggle to grow. The first two factors are particularly existential to a business. If there isn’t a strong Founder-Market fit, then the founders will hold back the potential of the business. If the market dynamics aren't that strong, then the business might be good and small, but not enormous.

In any case, founders should be monitoring these 5 factors regularly to proactively address any potential issues with the business. If you notice one of these factors lagging for a period of time, then there's a good chance that a small pivot needs to be taken to address it. If there are 2 or more factors that seem to be lagging then a larger pivot definitely needs to be taken.

The easiest way to spot gaps is by rolling out specific KPIs that address each of these factors. Whilst doing this exercise, make sure to note the influence incentives have on these KPIs.

For example, you might offer free credits on your platform to encourage consistent use, to encourage initial sign-up. As such, if you see an influx in new users, or high engagement, on the surface it might seem that you're on the right path to Product-Market-Fit (PMF) when in reality people are just taking advantage of an offer that is probably too good to be true.

In that same vein, strong market tailwinds can also hold a product afloat, longer than it deserves. At the moment, take any AI app that is released. Make a few tweet threads about the app and it's easy to get early users onboarded. For a while, this trend might continue and you'll have a nice chart that goes up and to the right. However, if you don't act on the interest immediately, there's a strong chance these users churn. What previously looked like PMF, no longer exists.

To really be a world-beating startup, you basically have to max out on all 5 points above. If not, then it's a strong indicator that something needs to change.

Timing a Pivot

As a venture-backed startup, if you want to survive and thrive, there are two options for you:

You're fully committed to going down the venture pathway. This means you should be in raise mode every 12 - 18 months

You don't want to raise continuously and you choose a path to profitability.

The timing of when you pivot is crucial for both options, but there are some slight nuances here.

Venture-Pathway

Growing a venture-backed is all about perpetually sustaining momentum. If you're able to demonstrate strong momentum, your future fundraises should be pretty easy.

Business momentum is shown through user engagement and product traction, or through revenue growth. This means that you need to be optimising for any of the following:

Hyper usage of your product. Your customers should be engaging with the product at a regular cadence (ideally daily or weekly). If it's less than that, then there's a good chance they don't really care about your product, it solves a small problem in their lives or it isn't useful enough for them to use it more regularly.

Onboarding new customers at an exponential scale. You're either attracting a bucket load of users every day, or you're attracting users who are willing to spend a lot of money on your product

Users are actively looking to spend more money on your product with a high velocity (e.g., expanding contracts or moving up to a higher tier within a few months, trial to paid conversion within a few days)

Ideally, all three of these are happening at once, however, if one or two of these things are happening, then figure out what's working and double down on it.

If none of these are happening, or they are happening slowly, then you almost certainly need to consider pivoting. Unfortunately, this is where most startups fail.

Remember my story about persistence earlier?

At this point, founders usually think if they grind hard enough, then things will change for the better. Unfortunately, that's rarely true, and by the time they find out - time is up.

Venture-backed startups need to move quickly. When you're raising every 18 months, waiting for 4 months to see traction improve is a waste of over 20% of your capital. There's a reason why the mantra of 'shipping fast' is spread across startups.

At Pre-Seed/Seed and even Series A stages, you need to be looking at your metrics on a weekly basis. If for any reason there is a dip, then it's time to diagnose what went wrong and look to fix it for the next week.

Monitoring the state of your business on a weekly basis covers any micro pivots or adjustments that are made, but the macro is just as important. Being a strong founder means that you're able to allocate capital well. When VCs make an investment in your business, that’s the bet that they are taking.

As such, when thinking about your business on a monthly basis, you need to be asking yourself whether you would still invest in your company. Obviously, there is a lot of bias that comes into play, but I sincerely urge you to be as objective as possible.

By doing this exercise, my hope is that you come to a strong realisation before it's too late. The best time to pivot is in a moment of strength. For a startup, this usually means when you have more than 12 months of runway and you have room to cut costs further.

Unfortunately, due to strong biases, and in some cases delusion, many startups pivot when it's far too late. This creates a crazy amount of pressure and stress to pull off a great escape. It is possible, but it's much better if you pivot early.

Pushing for Profitability

For businesses that have previously raised money and are going down the profitability pathway, the decision to be made here is even trickier. There are two main questions to answer:

Is it possible to get to profitability?

There is a huge opportunity cost associated with continuing along this journey - does it still make sense to pursue this vision and dream?

Determining if achieving profitability is realistic goes back to analysing the business and considering the product margins. If you’re putting up 80-90% gross margins, there is a strong case you can hit profitability. Between 50-70% likely needs some operational efficiency and tightening, and anything lower will require some pivot or product improvement to increase pricing and lower costs

The worst case here is getting to break even and then struggling to maintain that. Run the numbers for how many new customers you need to bring on and how much costs you can actually cut. Be realistic about whether this is genuinely possible, or if it's a pipe dream. There's nothing fun about running a business that isn't really going anywhere.

The second question is harder to answer as it’s more personal. For some founders, it will seem like there is no other alternative besides working on solving the problem that they set out to tackle. Others might be tired, exhausted or unmotivated to go through the grind, but might think it's the right thing to be doing.

In the latter scenario, it's almost always better to return capital back to investors and take a long break. Running a startup is incredibly tough and can take a massive toll on someone's mental health, clarity and even physical health. There’s absolutely nothing wrong with thinking about yourself first in this scenario.

Outside of this, if you do continue along the journey, and you do think there is a viable path to profitability, the best way to push forward is to ensure you are able to maintain a level of momentum either through revenue, customer traction or product releases.

By doing so, your team will find comfort that there is still a strong goal to be working towards. The worst part is if there is no momentum, and seemingly no goalpost to aim for.

Managing your Team

Throughout all of this, managing your team will be the hardest thing you need to do. Startups are all about uncertainty and navigating through it, but it's particularly hard in this case when you might not even know where you are headed.

In these cases, the best way forward is to just maintain a line of constant and regular open communication. Being transparent about the state of your business (including financials), and the possible avenues that might be explored will go a long way.

By doing so, you give everyone enough information to make a decision about their own future. When going through a pivot, you shouldn't be surprised by people leaving - instead, you should embrace it.

You want people who are in it for the long run with you and willing to grind towards an uncertain future. If you have people who aren't willing to do this, it will just slow down your pivot at a time when being nimble and fast is paramount.

I've seen a lot of founders make the mistake of trying to hide the fact that things aren't working well to 'protect' their employees. Instead, this approach just kicks the can down the road and doesn't adequately manage employee expectations. Remember, your employees are looking to you for their financial livelihood - by not being upfront and truthful, you could inadvertently put undue stress on them.

Conclusion

Navigating any pivot, even a small one, is tricky and filled with uncertainty. As such, most founders tend to shy away from pivoting too much. Living with the uncertainty of what might happen is hard and unnatural.

However, startups in general are filled with uncertainty and taking bets that don't seem likely to succeed. In that same vein, I urge founders to be more risk-seeking and to push themselves to do things that are more uncomfortable.

Each pivot will teach you more about yourself, your business and the market that you're operating in. If you ever think about trying something new or shifting your journey - I urge you to listen to that mental signal. It's too easy to push those signals away, but for you, it could be the difference between your business thriving and it failing.

To end on a funnier note, too many startup pivots end up playing out like this:

Make sure to subscribe now to not miss next week’s article

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi

Hi Abhishek,

Your posts are always very thoughtful. I like reading them. The topic of this post is very close to my heart. I've wrestled with this pivot or persist dilemma not just for myself, but also in my consulting work with founders. I have never successfully managed to convince a founder to pause or pull the plug on an idea until the cash ran out.

One thing I've realized is that most times it is about the journey rather than the destination. What I mean is, if one derives satisfaction from the effort, rather than the outcome, then the question of whether to pivot or persist is moot. Especially in the case of artists and creators, it is the joy one derives during creating that is the driving force rather than the eventual success that may follow. Similarly for entrepreneurs, it is the process of building something new that makes them content.

And ultimately that's what life is about, isn't it? Doing what brings you joy, peace, satisfaction, and contentment ...