The Art of Crafting Your Startup's Story (Upgraded)

An upgraded version of my popular startup storytelling article

Welcome to all the new subscribers that have joined us over the last week! If you haven’t already, you should check out my last article here:

If you like what you read, please subscribe to Superfluid here:

I’ve been having some really interesting conversations about fundraising and storytelling lately and felt that my popular post on startup pitches could be upgraded.

For those who have read the piece before, feel free to skim through it - I’ve included new charts, and examples and written more about how to craft a strong story with numbers - hope you enjoy!

Over the last few years in Venture, SaaS has stood for Storytelling as a Service.

Numerous founders were able to raise ludicrous sums of money off the back of being an incredible storyteller. Supposed crypto 'visionaries' and now AI 'savants' all project grandeur versions of what the future looks like and in response, investors willingly take out their chequebooks and ask them how much they want.

This is all due to large downstream investors moving from public to private markets, meaning that early investors were not left holding the bag for as long as they were used to.

The art of fundraising is an emotional one. You need to be able to tug on the heartstrings of the investors on the other side of the table. You have to be able to eloquently convey your vision and make them feel like they're missing out if they don't invest in this current round.

One potential pathway to raising money easily is to come through with a stacked resume. Ex-Paypal/Facebook/Canva/[Insert massive unicorn here] employees are always in high demand and typically attract the largest pre-seed and seed cheques. But what do you do if you aren't from a prestigious background? How do you tell your story and build credibility with VCs who can be incredibly fickle with their capital and time?

The Big Picture

Before you even think about starting to talk to investors, you need to think about what your big vision dream future looks like. Now, I don't mean you should recreate a Jetsons episode with talking robots and flying cars (unless of course, you are building either of those things!). Rather, think carefully about what your overall 20 - 30 year goal is. You want a goal that is both audacious but also believable. That might sound a bit contradicting but stay with me.

Mel from Canva had a very audacious goal in her first pitch deck. Her vision was "To replace the Microsoft Suite as the world's dominant publishing platform". That's an audacious goal for 2011 when Microsoft had a 94% share of the desktop productivity software market.

And to many investors, that wasn't a believable goal. Mel had to do 100s of investor meetings before she was able to raise her seed round. But, if we're smart about how we communicate our audacious goal, you won't have to go through the same pain.

To make a goal believable you have to break down the journey to getting there. As a result, as the founder, the onus is on you to be able to illustrate what your future looks like, but also the path to getting there in palatable and logical jumps.

Sticking to the Canva example, Mel chose design as the first vertical to target due to her close proximity to the subject matter.

Now, it's hard to say whether she expected to have so much success within this one vertical, but much of Canva's journey to date has been democratising design. It's only recently that they've expanded horizontally to start tackling the other Microsoft verticals with their recent product releases of Docs.

Whilst Mel's path may have taken a different journey than she intended, she had some clue as to what steps to take initially and how to position the company so that her end goal seemed more reasonable.

That's great for Mel, but how do you do this practically?

First, let's start by working with the tailwinds in your industry.

Write down a list of all the tailwinds that are impacting your chosen market

Categorise each of these as High, Medium or Low with regard to the magnitude of their impact on the market

Also, categorise them in terms of importance to your startup

Now, try and hypothesise the following: "What would the world look like in 10-20 years’ time once those tailwinds have eventuated? Will new tailwinds emerge from existing ones? What could these Tailwinds be?"

The material from the process above won't directly make it into a pitch deck but it will help you think bigger and with more ambition. This enthusiasm and sense of scale will filter through as you start pitching your companies to VCs.

Now, let's talk about the headwinds that might hold your startup back.

In life, there are known unknowns and unknown unknowns.

Known unknowns are things that you know that you don't know and hope you'll be able to figure out along the journey. Maybe a specific feature isn't as useful as you think it is, or sales cycles are longer than you expect.

Unknown unknowns are things that you are completely unaware of. These could come in the form of unexpected technological shifts that render your product obsolete (similar to what AI is doing to incumbent tools), or it could be an unexpected change in regulation.

Investors are looking for savvy operators. They want to know that you have thought about all the possibilities of where a startup could fail, well in advance of themselves.

What headwinds currently exist for your business and the market that you're operating in?

How are incumbents positioned relative to your business?

Will incumbents notice or care about what you're building? And what happens once they start replicating your product? How will you deal with added competition?

What are the incentives in front of them to keep you out of business?

What are the existential threats to your business?

These are just some of the questions you should ask yourself, and mentally prepare yourself to answer during the DD process. If you have well-thought-out and reasonable answers, you'll be able to impress VCs early and come across as a self-aware founder. However, the key here is that the answers need to be reasonable. I've been in numerous calls where the founder trashes their competition, or claims that they're right and the market is wrong, but as Keynes said “Markets can stay irrational longer than you can stay solvent."

The world to you as a founder may seem irrational - that's why you're building a startup. But, don't let that blind you from reality.

Storytelling With Numbers

Despite investors claiming that they make investment decisions on a person's qualitative talent or even vibe, we all love numbers to help justify why we're investing in a company.

This next section depends on the stage of your business.

The startup has a product in market and is revenue-generating

If you’ve got traction, VCs will start to judge you through benchmarks. They’ll analyse your burn rate, growth rate, magic number and a whole host of other financial metrics.

The best case is that you’re smashing all of the benchmarks. In this case, your fundraise should be straightforward - VCs will be lining up to give you capital.

The more common case is when you have some metrics that are really good, some that are average and some that aren’t appealing at all. This means the fundraise might be harder depending on how much money you’ve raised in the past and your prior valuation.

The first part is acknowledging that this is the case - too many startup founders delude themselves into thinking that their metrics are great. This is to their own detriment as they won’t be able to answer questions properly and craft a story around why the metrics are what they are.

Traction is the outcome of the bets you’ve taken to date.

They validate whether you have taken calculated bets that have paid off, or whether you’ve doubled down on the wrong things, and are too slow to change your strategy. They also serve as a validation tool for the tailwinds that you’re chasing.

For Seed and Series A fundraises, you need to:

Define the short-term tailwinds that will drive growth over the next 12 - 18 months. For some startups, this might be an impending regulation that requires people/businesses to start using new software. Alternatively, a startup can accelerate the importance of a tailwind through its own product features.

Explain how you will spend capital to capture that opportunity. More often than not, this will relate to the Go-To-Market (GTM) strategy, but in some cases may be product-related. If it is GTM-related, ideally it is a repeatable formula that you have already tested and proven successful with.

The startup has a product in market and is pre-revenue

There are two ways to validate a product:

People want to give you a lot of money to solve their problems (e.g., B2B Enterprise Software)

People spend a lot of time using your product and have high retention (e.g., consumer social platforms)

If you have a software product that is live and has traction, but no revenue, the metrics that matter are usually engagement and retention rates. You need to show investors that once you start charging for the product, you’ll be able to still retain a high percentage of existing customers or you’re able to monetise the platform in some other way (e.g., Ads).

Depending on the macro climate, this will be an easy or hard sell to investors.

The startup that is pre-product and pre-revenue

If you are a founder of a pre-product or pre-revenue, the investment decision will be predicated on the market opportunity, your dream and the quality of your team.

We’ve covered how to work through the first two criteria already. Most people think that the quality of a team is solely based on their credentials and qualifications. Whilst in part this is true, there are other ways to impress if you don’t have a stellar CV.

The best way to impress is to show that you’ve deeply thought about your business and understand the levers for growth that will dictate whether you will be successful or not. You need to show structured thinking on how you will build your business.

Whilst plans and strategies change once you have customer feedback, you need to show VCs that you can dream big but also think in a structured and logical manner. On the metrics side, to stand out from most other founders, you need to do the following:

Compile a list of metrics that you want to track. Typically these will be related to product usage levels, revenue, and traction. With each metric, tie this back to incentives or the levers that influence each metric.

Whittle this list down to the top 3 metrics that are actually core to your business' success.

The key part of this process is understanding the incentives that drive each metric. Many founders overlook this part of designing a metric and end up optimising metrics that don't necessarily align with the success of their product.

For example, an AI-based chatbot company might measure the number of messages sent by a single user as a signal for good engagement, but what if the purpose of the chatbot was to answer questions efficiently and effectively? In that case, higher message numbers might not be the best measure of customer love.

Mapping out incentives accurately, and thinking through how you define North Star metrics earlier on in your journey will allow you to be more targeted and optimised with your entire business. Keep in mind, that the metrics you track may change, or the definition of these metrics might change, but at the end of the day, what gets measured, gets managed.

Pitch Decks (the bane of my existence)

So far we've discussed some fluffy stuff around ambition, and market context. We've also talked about quantitative metrics and how you can show your savviness. But what about the pitch deck?

Pitch decks are an essential tool for framing and conveying the story of a startup, but they are not always used effectively. The first thing to note is that the purpose of a pitch deck is literally to secure a first meeting with an investor. It's not to convince them to invest in your business.

That might seem confusing, but stay with me.

To secure a first meeting with an investor, you need to present your company as a reasonably investable proposition. The investor needs to feel like taking a meeting isn't wasting their time and that there is some logical substance to what you're building.

For them to invest in you, they need to believe in 3 things:

That you're the right person to tackle the stated problem,

That the market is ripe for disruption,

Your product is positioned correctly to take advantage of this.

If you've followed the steps so far in this article, you should be able to convince an investor that you've thought deeply about the problem, you have an intimate understanding of the industry and the potential shifts that will impact the industry and your thought process behind disrupting the market.

Hopefully, that's enough to convince someone to invest in you.

What we haven't covered is how you actually get a first meeting with an investor. Though the first meeting comes before the investment decision, there's a reason I've structured this article like so.

It's important to do this amount of thinking and research before you even open PowerPoint/Canva/[insert tool here] to start your deck. You need to know what the overall message actually is before you start writing. Otherwise, your deck will be long, meaningless and ineffective.

So, how do you actually structure a pitch deck?

The first thing to keep in mind is that there is no perfect structure. Every VC will want different things included. The framework below should hopefully force you to think exhaustively, but also be precise with your language.

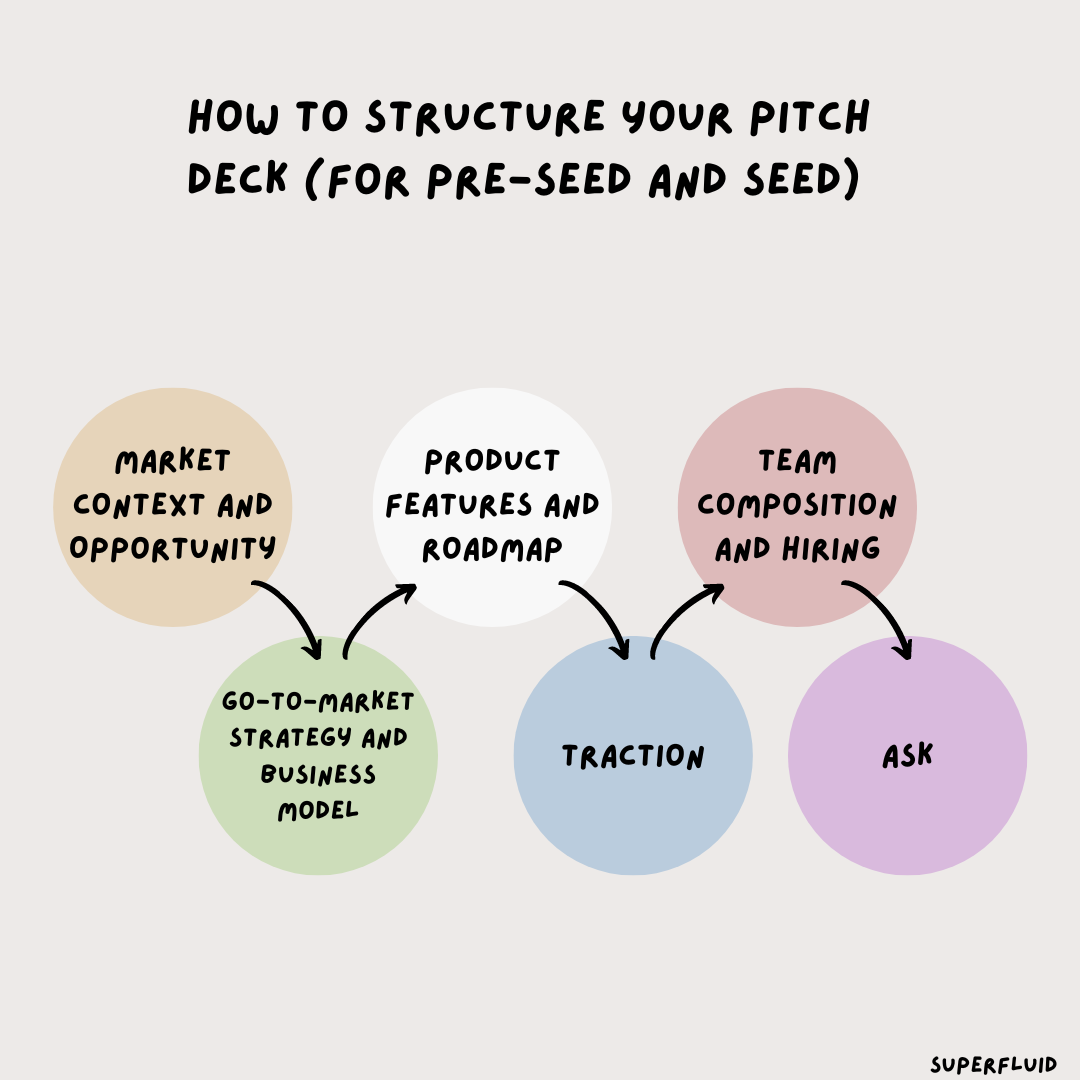

There's nothing revolutionary about this structure. But what's important about this, is how each section builds off of the previous sections.

I like to follow the structure below:

Start by laying out the context. Include details on market tailwinds and market size

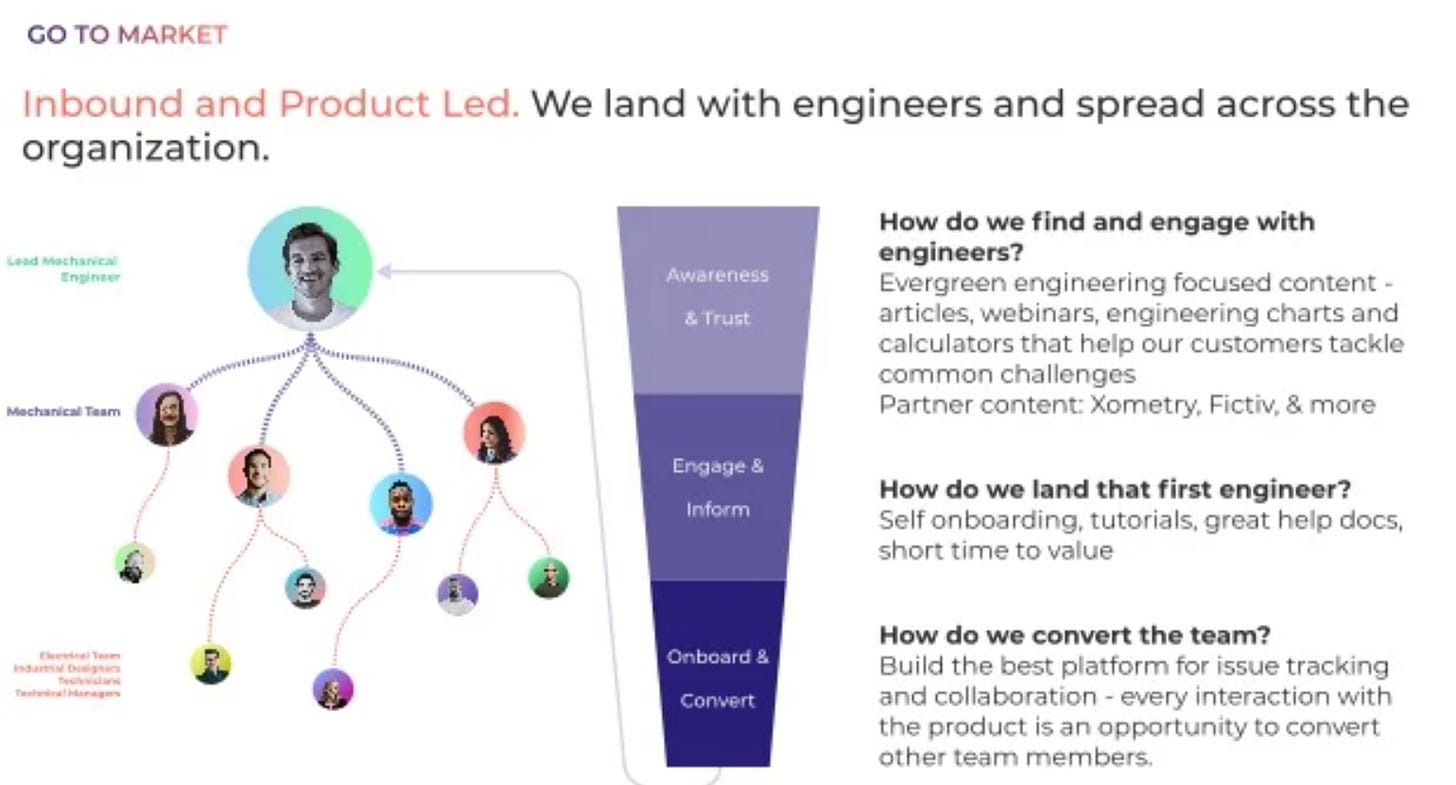

With this context, identify the ICP, and their buying patterns. If it’s targetting individual contributors in an organisation, then perhaps PLG is the right GTM strategy. Your business model changes depending on who the buyer is.

Your product features and architecture will change depending on the GTM strategy and business model

Traction is the outcome of the bets you’ve taken so far (on GTM, business model and product)

More traction gives you the right to double down on what’s working and potentially increase the size of your team to build a better product, scale sales etc.

This translates into your ask. Be clear on the following: The benchmarks you need to hit by the next round and the resources you need to hit those benchmarks. Using these inputs, calculate how much capital you need to execute this plan and contend with any mishaps along the way.

Many founders neglect this structured and systematic approach towards communicating their startups. In many cases, there is an incongruence between the GTM strategy and what type of customers the startup is trying to acquire. Or there is a mismatch between the hiring plan versus what the startup actually needs.

Most pitch decks tend to have the same mistakes in them, so here are some helpful pointers and tips to make your pitch deck stand out:

Market Context and Opportunity: The standard way to show this is through a TAM slide, with three big bubbles that all have a large number inside them.

That's a good start as it directionally shows how big the market is. However, founders typically end up stretching the market size (usually increasing numbers by a factor of 10), or intentionally sizing a larger market (e.g., showing the size of the entire advertising industry versus just TV advertising). Neither of these are useful tactics for getting an investor to believe in your ability.

Instead, I think you can really stand out if you can show some level of nuance or thought around why you've sized the market a certain way as opposed to simply quoting an online source and how you think about your Serviceable Available Market today, versus just quoting 1% of your TAM.

Team: A startup’s early defensibility is garnered through the calibre and quality of the team. There’s no standardised way of showing that unfortunately, as people have varied skill sets that aren’t always reflected in their prior work experience or their university/college.

The slide below from Orange showcases a pretty impressive team. You’ve got ex-Tesla engineers, ex-founders and serial entrepreneurs. Yet, I could say the same thing if I were to intern at Tesla for a month and start my own e-commerce brand or mobile app.

Whilst I’m being facetious, I think it’s more important to focus on your achievements in the past. For example, did you manage to scale your mobile game to 10M+ users, or at Tesla, were you fundamental to an engineering breakthrough that allowed xyz to happen?

Ideally, the achievements you have are related to the business you’re building now. If you can draw a line between something you’ve done in the past and what you need to do in the future, that should be included on your team slide. Remember, early investors are backing your unique ability to take advantage of the market tailwinds - make sure there is no doubt that you have the right team to do so.

GTM Strategy and Business Model: Most GTM and business model slides can be copied and pasted from one deck to another. They have a tendency to be generic without much insight. As an investor, this is a huge red flag.

Especially now, in a recessionary environment, founders need to be strong at sales and distribution. Without understanding the purchasing cycles of their market, who the key buyer may be, and what pricing strategies should look like, it makes it hard for an investor to believe that you've thought deeply about your startup.

For this section, again, it's important to link back to incentives and drivers for product adoption. If you're selling to large enterprises, ask yourself if a PLG motion actually makes sense. If you're selling a software product to be used by numerous people in an organisation, question whether it makes greater business sense to adopt a per-seat pricing model versus a flat annual contract.

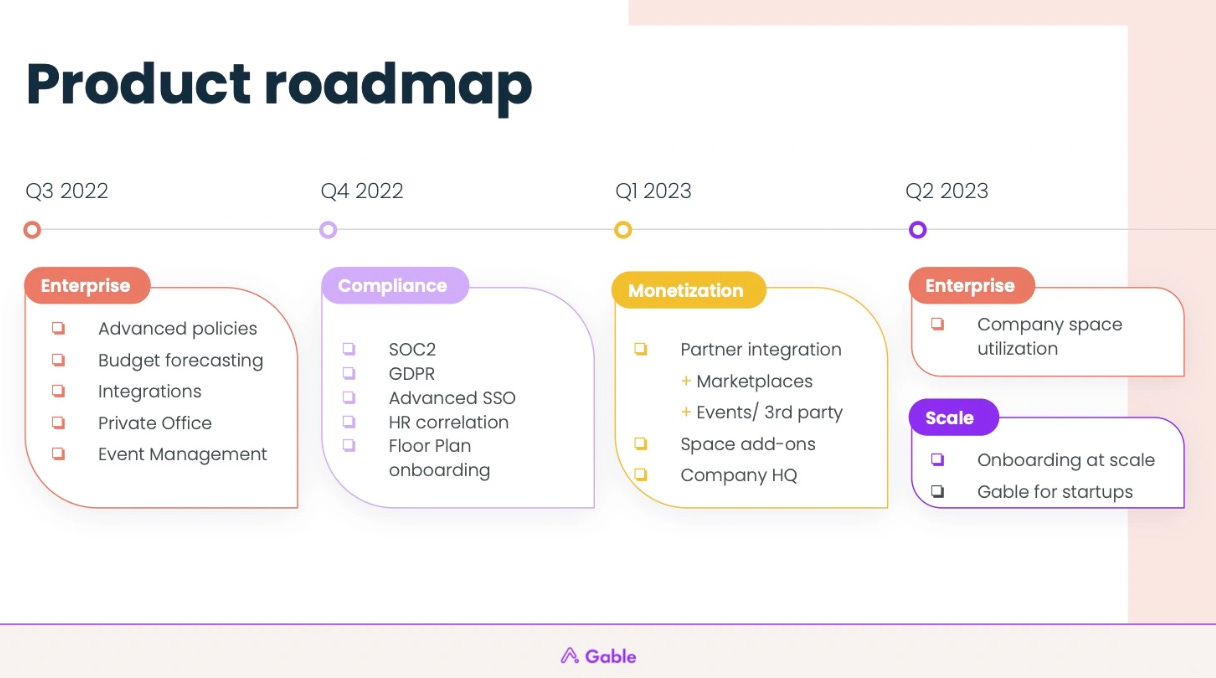

Product Roadmap: Typically shown through a breakdown of when certain features will be available by, Product Roadmaps are woefully presented by founders. Arbitrary terms such as "improved analytics suite" and "improved UX" rarely mean anything to an investor without framing the context properly.

Here’s an example of a poor roadmap slide with arbitrary jargon and features listed out like a shopping list. It’s better to not have a roadmap slide than to include something like this. Instead, I would urge founders to link new product features back to a customer need or to a tailwind more explicitly. This will show that you've thought about why you're building a certain feature and how you’re prioritising when it gets built. We've also spoken about moat trajectories in the past here. Make sure to include a reference to how certain features will compound or build your moat over time.

Ask: Usually Ask slides have the following line "We're raising $2M to hire engineers, build product and achieve $500K ARR in 18 months."

Hiring engineers, building product and achieving a certain level of revenue is what every startup is planning to do.

What's actually more interesting and useful to know is the pathway towards getting there. For example, how many customers would it take to achieve $500K ARR and is that a reasonable goal given you need to build an MVP from scratch? Or, what user engagement benchmarks have you set for yourself over the next 2 years to show customer love and validate your product?

What happens if they say no?

You've done all this thinking and linking, what happens if an investor says no?

Well, your ability to continue telling your story doesn't stop.

First and foremost, you should push them to give you a reason as to why it's a No. In some cases, you might get a reason that is based on the mandate or that your idea isn't that compelling and that's okay. However, if they give you a reason related to the market context, GTM strategy or product vision, this gives you a certain level of insight into what that particular investor might want to see going forward.

To take advantage of this, you should continue to update investors on how your startup is mitigating their concerns over time. If you show consistency and results you'll be able to showcase your thesis coming to fruition.

Concluding thoughts

The steps in this article will take time to complete and are rigorous for a reason. In the current environment where capital is scarce, you need to go a step beyond what other people are willing to do. Whilst investors understand that not everything will be perfect in an early-stage company, we still have a fiduciary responsibility to invest their LP's money in a responsible manner.

The key to storytelling in startups is being able to communicate you have unique insights and that you're strongly positioned to build a large business. Being able to link industry tailwinds, product features and thinking around incentives throughout your business is the easiest way to do that at the pre-seed and seed stages.

Make sure to subscribe now to not miss next week’s article

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi

"In life, there are known unknowns and unknown unknowns." - Indeed! Thanks for sharing your insights.