Teardown: How Linkby raised its $15M Series B in 90 days

Chris Wirasinha, Founder & CEO, shares how he raised $15M for Linkby.

Over the last couple of months I've been working closely with a number of founders on navigating the VC fundraising process and on a variety of 0 to 1 problems (GTM, Product, Operations).

It's something that I've always done as a VC during my nights and weekends, and now it's even better to be able to do it full-time.

Whether you're preparing to raise, stuck on positioning, or just need someone who's sat on both sides of the table to pressure-test your thinking, I'd love to help.

Feel free to DM me on Linkedin, hit reply on this email or book in some time via my Calendly below.

During my podcast episode with Chris from Linkby earlier this year, he lightly teased that they were going through a Series B fundraise. Since then, Linkby, a Performance PR platform helping brands connect with publishers, newsletters and creators, successfully raised US$15M from Volition Capital, a Boston based fund which is an awesome achievement.

As a founder, you’re never really certain how a fundraise will pan out.

There are so many weird incentives that VCs are guided by, and sometimes it can feel like a game of luck.

That was the problem that I sought to solve when writing The Fundraising Blueprint, but even so, it can be hard to see how the tactics might apply in real life.

And so today, by taking an inside look into Linkby’s Series B raise, we’ll add more colour to the tactics covered in my book, and see firsthand how these can help you drive towards a really successful outcome.

"We thought the seed would be easy. It turned out to be hard. Then I thought the Series A would be easy. It turned out to be harder than I thought. So I thought the Series B would be hard, and it turned out to be actually the easiest raise out of the three because we were so well prepared" - Chris

Building Strategic Clarity

I’ve spoken about the importance of pre-work before, and even have a full section dedicated to it in my book.

The purpose of breaking your business down into different sub-categories (market, context, product, team etc.) isn’t about building a better pitch deck or collating enough information to fill out your data room, but rather, intimately understanding the business that you are building.

This clarity reveals your unique market leverage which in turn helps you build a stronger business and craft a more compelling fundraising narrative.

Some founders already have this clarity and can skip the deep analysis, but most need to work through it systematically.

In the case of Linkby, their pre-work was largely centred around category creation.

If you have not heard about category design and ownership before, in short, it is the strategic practice of defining and dominating a new market segment rather than competing in an existing one. The purpose of doing this is to ensure that your customers believe that you are the only player in a certain category even if you might have adjacent competitors. (Check out Play Bigger to learn more)

Between Linkby’s Series A and B, Chris had a realisation that they weren’t sharp enough on what category they distinctly owned, and instead had been trying to fit into existing categories, or shape their narrative based on the current investor zeitgeist.

"I think in the seed and the series A, I hate the term impostor syndrome, but I would say that I've always felt that because we're not building enterprise SaaS, there's this need to kind of try to dress ourselves up as something that we're not."

The breakthrough came when they settled on their category title "Performance PR". It was a category that they had created, and flew in the face of what PR is traditionally seen.

As Chris put it: "It's exactly what we do, and no one in the world does this better than us."

This allowed Linkby to get clear on their specific value proposition, and also gave them a distinct tagline that they could run through the fundraising campaign.

From here, the second piece of pre-work that was particularly needle-moving for Linkby was how they communicated their traction and the operational leverage that they had built within the company.

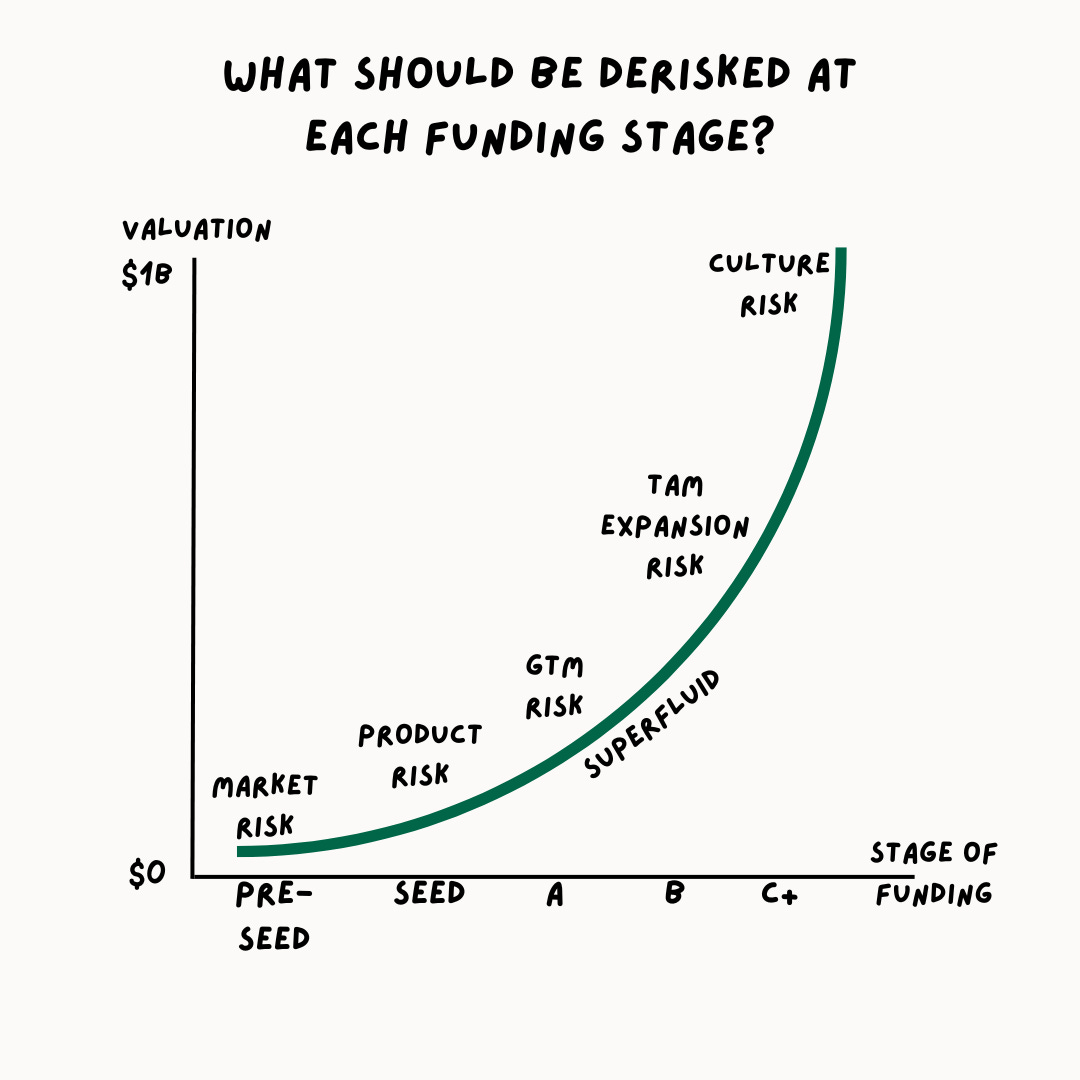

This part is similar, yet different across various funding stages as investors have varied risk tolerances depending on company maturity.

As I've covered before, Series B investors typically underwrite two key risks: can you scale your go-to-market strategy, and can you expand your addressable market (either geographically or by moving upmarket)?

Indeed, proving these capabilities takes time and intentional execution post-Series A and so Chris made the counter-intuitive decision to turn down early investor interest and delay Linkby’s fundraise by several months until they had undeniable proof points.

Once ready, Chris documented these proof points within their financial model, to show that they had:

a proven sales playbook, where sales reps ramping up quickly and consistently generating $100K/month in platform revenue within a few months of starting

strong signs of US traction, with 100%+ YoY growth

and a strong view on where they would deploy further capital to accelerate growth

Designing Your Fundraising Process

Unfortunately, the planning doesn't end with pre-work.

The key to any fundraise is to always be building momentum, both within the business and for the fundraise itself. While most founders nail the pre-work, they often rush into investor meetings without proper orchestration of the process itself.

Chris focused on three specific preparation tactics:

Target list development: Building and enriching a list of investors based on their interest areas and existing investments

Meeting scheduling: Booking all investor meetings 3-5 weeks in advance to ensure they happened within a concentrated timeframe

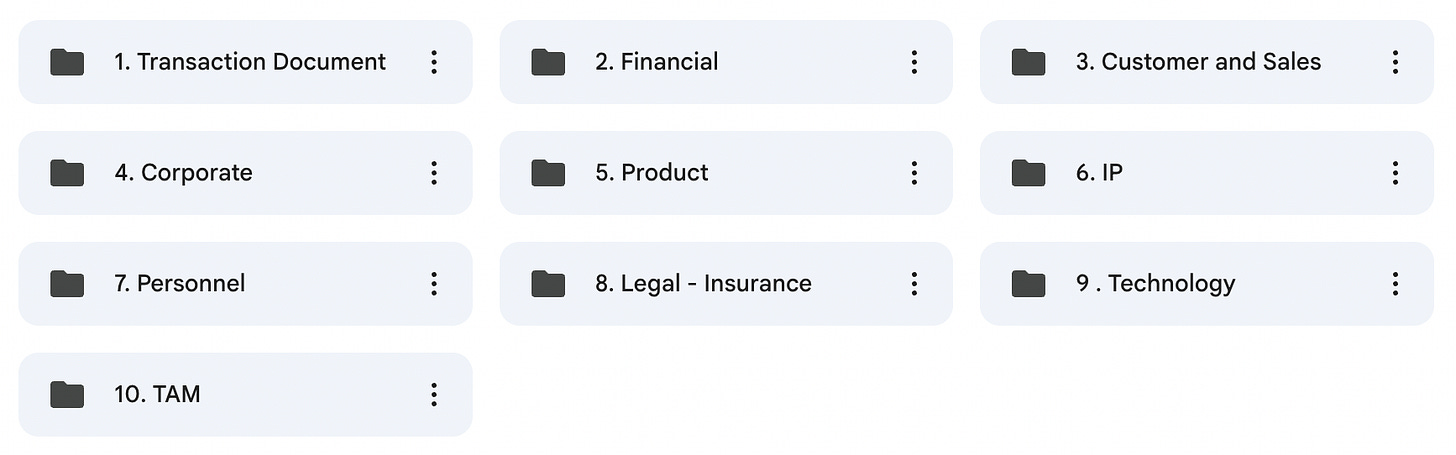

Answer vault creation: Documenting responses to questions from previous raises and practice pitches with existing investors along with a detailed dataroom that’s finalised before your first meeting.

Out of all of these, Chris felt that the answer vault made the most difference during the actual fundraise process.

By running through practice pitches and writing out answers to past questions, Chris felt like this helped reinforce the pitch in his own mind, and made him more prepared for curveball questions, almost like studying for an exam.

Chris was so obsessive over this that he "literally practiced [his] answers in the shower every morning. By the time we started meetings, [he] could answer anything in [his] sleep".

I'm not sure if I've ever met a founder who's actually gone to such lengths before, but I think it does set the gold standard for founders out there.

Building and Maintaining Momentum

By scheduling all your investor meetings within concentrated blocks, you get the benefit of being able to run a true auction process where the goal is to get a few funds to crescendo into a term sheet around the same time.

Chris organised his investor blocks as follows:

Week 1: International investors (morning: East Coast US, afternoon: West Coast US)

Week 2: Australian investors (face-to-face meetings where possible)

Week 3: Completed initial target list + second meetings

By week 3, Chris could identify serious prospects and nudge others along by following up with additional context about how fast other investors were moving. This forced the slower investors to either commit to another meeting, or drop out of the process entirely.

It’s absolutely necessary to have real momentum with at least one fund to get to term sheet stage. Any hiccup or delay at any stage risks killing the deal. You might think I’m exaggerating, but believe me on this one.

From past experience, this was something Chris understood and was able to act on proactively by creating his ‘Answer Vault’. This meant that through the fundraise, Chris was able to maintain the momentum by responding to investor requests quickly, within hours versus days.

"Everyone's heard stories of fundraises that have dragged on and then metrics change or something changes in the business. So you have a bad month and all of a sudden, the investor gets spooked."

The other interesting bit of feedback from Volition was that: "One of the intangible data points we've always seen in our successful portfolio companies has been companies that during the raise process got back information and answers quickly."

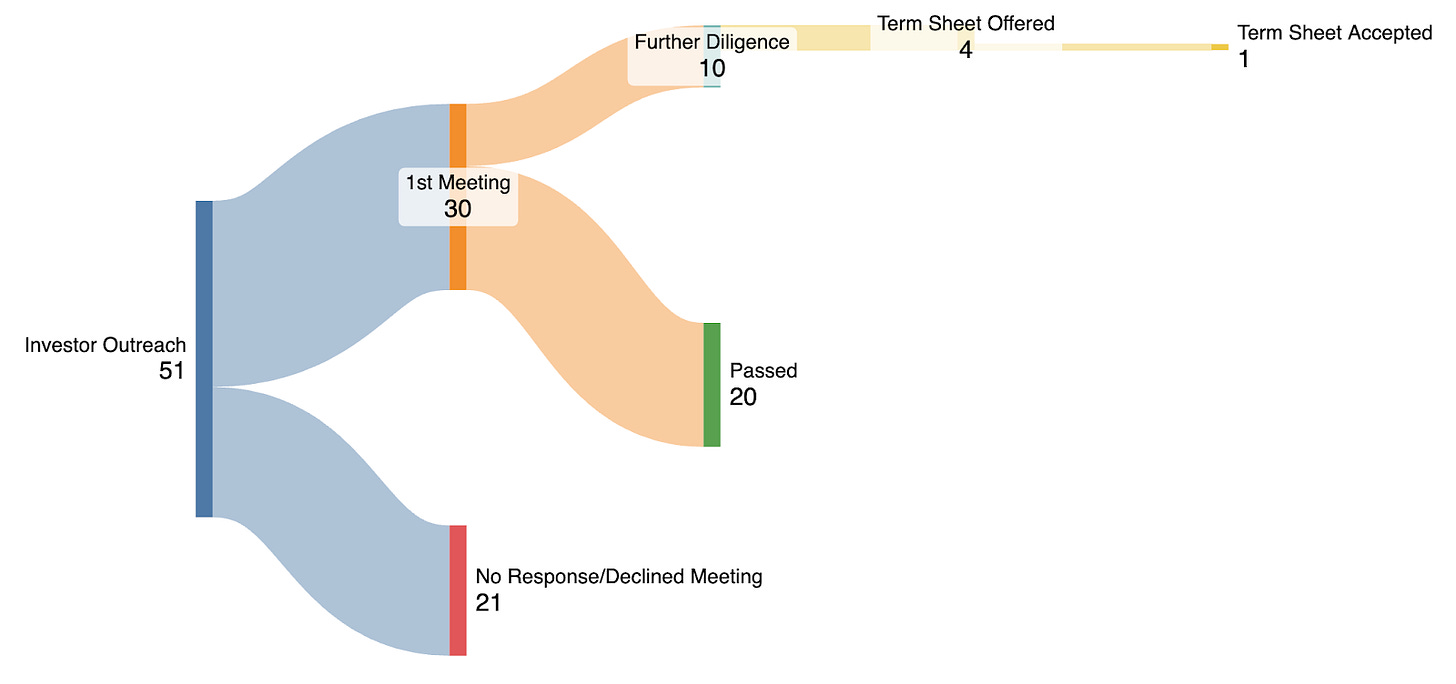

Fortunately for Linkby, they smashed the fundraising process out of the park, securing four offers and term sheets from their process. Whilst Linkby had interest from a wide group of smaller investors too, the team decided to select Volition Capital on its ability to close out the rest of the due diligence (legal, financial etc.) within a month and offered a more attractive valuation as well as the appeal of their experience with marketing tech and US base.

The Sankey diagram above shows you exactly what an efficient fundraising process looks like when executed properly. Notice how Chris didn’t waste time chasing every possible investor and just focused on the ones that were truly engaged and willing to lean in further. A targeted approach allows you to build and maintain momentum with the investors that matter, and also drive to a great deal at the end of the process.

Key Takeaways

Being able to raise any amount of capital, whether it’s $500K or $15M is a truly awesome achievement and can be equally hard. Linkby’s raise wasn’t only a product of the work that Chris undertook in the months leading up to the raise, but a compound effect of their ability to execute since inception.

In saying that, by taking a systematic approach to raising capital, Chris positioned the business for success. In this case, the most replicable elements from their process are:

Pre-fundraise preparation leads to pitch perfection. Chris intentionally delayed Linkby’s fundraise to get clarity on their category and to build undeniable proof points. This groundwork meant he could answer any investor question with conviction rather than scrambling to build credibility during meetings.

Momentum is fragile and requires active management. Talking to the right investors, qualifying them early and responding quickly to requests helps maintain momentum through your fundraise.

Compressed timelines create real competitive pressure. By scheduling all meetings within a 3-week window, Chris forced investors to make decisions rather than defaulting to "let's circle back."

Make sure to subscribe now to not miss next week’s article

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi

Thank you Mr Abhi