What makes something defensible?

Breaking down moats and opining on the future of VCs investing in SaaS

Welcome to all the new subscribers that have joined us over the last few weeks! If you haven’t already, you can read my last article on Gene Therapy here.

Stay up to date with Superfluid by subscribing here:

I can remember hearing about the importance of moats for a business ever since I started in venture, however, what a moat could look like has evolved rapidly. It definitely seems like we’re at an inflection point, fuelled by the release of GPT-4.

Some of you might have come across the demo of GPT-4 which takes a sketch of a website and spits out a carbon copy of it. Pretty insane stuff!

Since then, ‘experts’ on Twitter have declared that all product moats are dead. VCs are prone to passing on companies for having 'no defensibility' or 'no visible moat' and as kings of weak excuses, I expect VCs to rely on this more going forward.

So this all raises a couple of interesting questions:

What do founders say when they get asked about their product defensibility?

Is SaaS as an investment thesis dead?

I’ll try and answer both of those questions in this article - let’s dive in!

What's in a moat?

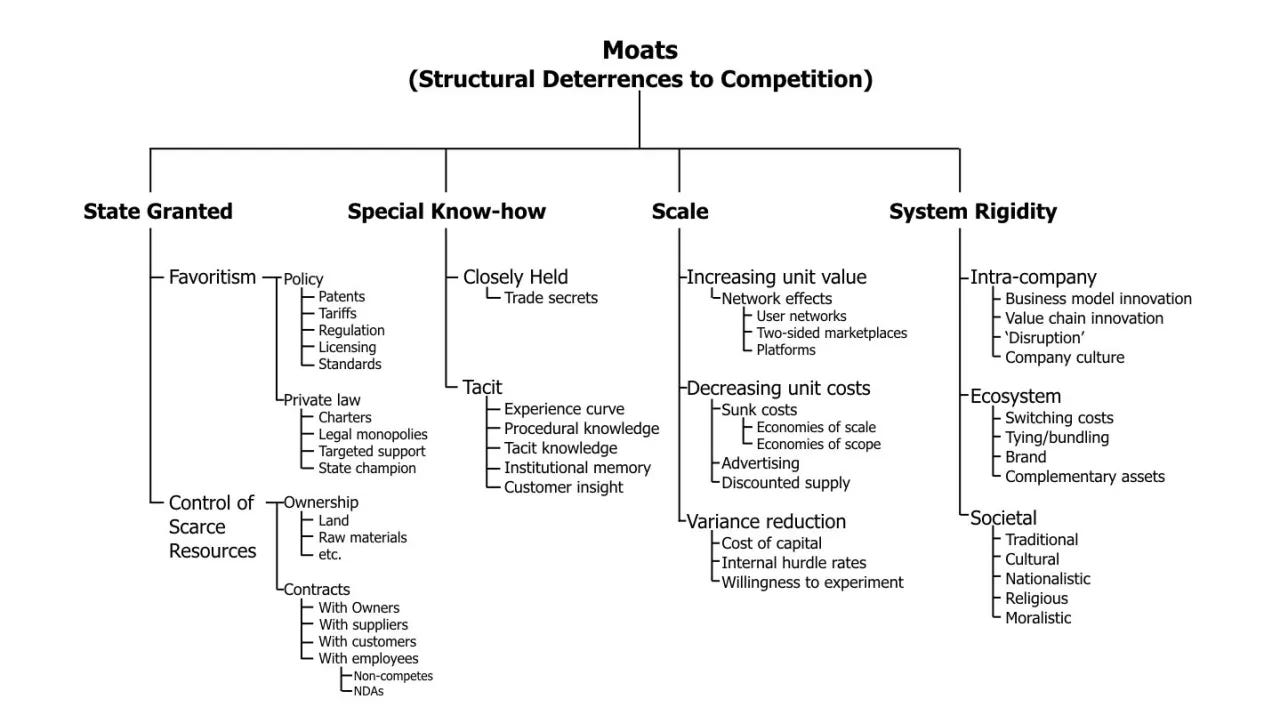

There are so many different types of ways to describe what constitutes a real moat and some investors/founders anchor to certain moats more than others. Infographics like the following have made the rounds time and time again and are useful in classifying the different moats that exist.

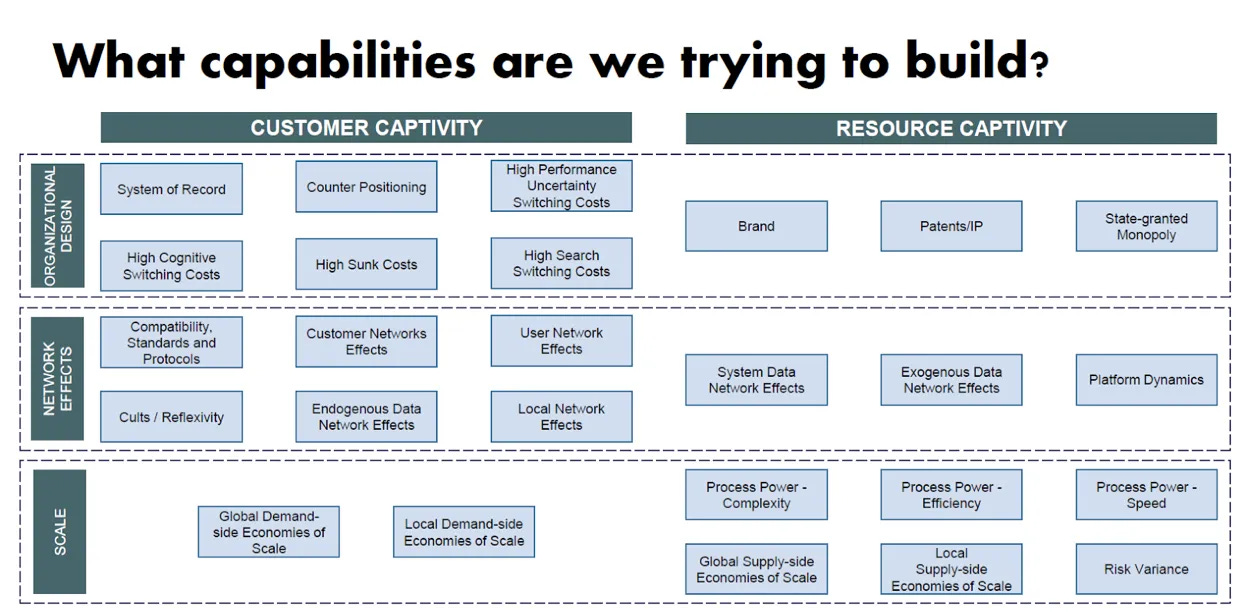

We've also got Hamilton Helmer's 7 powers or as Rick Zullo from Equal Ventures likes to call them, 'capabilities': "intangible assets that you have developed as a business that enable you to operate more effectively and earn returns above others in the market".

But for a new founder, especially at the pre-seed and even seed stage, it can be difficult to internalise and prove whether you have network effects or not, or whether there are switching costs associated with your product. Instead, I personally like to frame moats using the following framework also presented by Rick Zullo. The 3Ps are as follows:

Proven — Measurable, quantifiable and significant enough to demonstrate economic leverage

Perpetuating — The ability to provide increasing returns to scale and demonstrate sustainable margin growth over time

Permanent — Long-lasting and resilient to tactical attempts from competitors (i.e. not just short-term competitive advantages)

Realistically, no pre-seed or seed-stage business has a durable moat. The path to building your moat will take time and effort. But you still need to know how to communicate what the journey is to get there.

Moat Trajectories

In the current environment, the focus on this is already high and will continue to grow over time as base-level infrastructure continues to improve and make it easy for SaaS businesses to achieve a certain level of sophistication. Founders should start messaging their moat trajectory to VCs from the first meeting, with a focus on the following points:

How product velocity increases over time - Startups typically win by shipping faster and superior products with low amounts of tech debt. Moats are perpetuated and proven with strong product development. How do you, as the founder, plan to instil this culture and ethos within your business?

How your product is creating permanent and perpetuating stickiness - Clarity around, why and how for each new step of the roadmap, ideally accompanied by customer validation is paramount (i.e., XXX customer requested this feature, and we have validated this with 10 other potential paying customers).

How customer incentives are tied to your business model and pricing strategy - many founders default to basic SaaS pricing or usage-based pricing without thinking about the incentives each model brings. e.g., Does it make sense for a product with low recurring use to be on a monthly SaaS pricing schedule or should it be structured as an annual contract or something completely different? As it becomes easier to build a sophisticated SaaS business, business models and pricing innovations will become more important as customers will need a way to distinguish between similar product offerings. Make it clear to the VCs how customers are incentivised to adopt your product as well as maintain and increase their spending over time.

Less VC scale businesses in the future?

I've previously written about venture scale outcomes and how only a narrow subset of businesses are truly suited for venture capital. This thinking has also been perpetuated by other VCs such as Bryce Roberts who recently wrote that "VC is the wrong product for most businesses, even for those that raise it".

So, with lower barriers to entry to creating a world-class SaaS product and with AI already so powerful, what does this mean for VCs and how they construct their portfolios?

Indeed, there are a few points of concern that need to be addressed:

Increased competition - As Peter Thiel says 'Competition is for losers'. No VC wants to invest in competitive markets as this means capital is burnt purely on distribution (a la Uber vs. Lyft) rather than technical R&D.

To date, we've seen most markets trend towards being a 'winner takes all' or 'winner takes most' dynamic. With increased competition, either this remains the case, and there is a huge long tail of businesses within each market, or returns are more evenly distributed. Neither outcome is that great for a VC. It means that the probability of success is lower across the board if there is a longer long tail, or it means that return outcomes are dampened if business revenues are evenly distributed across a market.

Data as a moat - At the moment, every company that is using AI in some shape or form and claim to be able to fine-tune open-source LLMs say that the data they collect gives them a strong moat for the future. There is some truth in this, but largely it’s a huge misnomer.

At the start of a company’s journey, regardless of if it's an AI company or not, each bit of data it gets will 100% help it refine its product. But the quality and usefulness of future data capture almost certainly follow an asymptotic curve. New data will overlap old data and the lessons and takeaways will be lower with every new batch of data.

Short-term thinking - With reduced barriers to entry towards building products and enhanced competition this can encourage short-term thinking. As we all know, venture and business building is a long-term game. Product visionaries typically win with a long-term product roadmap and intentional product development.

However, if it's easy to make incremental additions to your product, or it's easy to copy competitors’ features, this poses a significant threat towards aligning a company's mission and thinking about the bigger picture.

Super vertical specific companies - In the first iteration of the internet we saw wide, horizontal companies win and win big. From here, we've seen the rise of vertical software and specialised tools for specific industries. This too has been a winning strategy as founders are able to deliver a product that is targeted at the needs of that industry.

In the future, we will likely see even more 'niching' as businesses try to gain competitive advantages in deep niches accompanied by low visible TAMs.

As such, VCs will need to believe that these products will be able to create a category within the deep niche and create enough value for the business to be meaningful. However, in most cases, there is a natural cap on the value a business will be able to create within a specific niche, and this is likely to be incongruent with current fund sizes. Maybe there is a future rollup play that might work? Tough to say now, but historically the world has been dominated by power laws - will this time be different?

So based on this, I suspect that VCs will need to be even more selective with the companies that they invest in, but should also be more willing to invest in unfamiliar areas such as biotech, hardware and robotics and other deep tech areas where product advantages are more clear, competition is low and IP is secure.

So, what are the takeaways?

Zooming back out, in startup land, all roads lead to product. The most important thing for you as a founder is to purely focus on building a product that is thoroughly validated by customers. For a moat to even matter, your product needs to be useful enough to distribute widely, and you need to have the right to win in your segment.

Moat building is literally a function of time, and going forward, I expect that moats will gravitate towards companies with unique GTM strategies or innovative business models that closely align with customer incentives versus a standard monthly SaaS model. We'll see more standardised features across the board, however, 'superniche' software products will contain features that matter for their core ICP with no added fluff. Almost certainly, VCs will try to make this work, but in the context of fund sizes and the evolving VC landscape, it could prove to be their kryptonite.

Make sure to subscribe now to not miss the next article.

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi