Everyone Thinks They Are Underfunded

In a world without constraint, constraint will win.

Welcome to all the new subscribers who have joined us over the last week! If you haven’t already, you should check out my last article here:

If you like what you read, please subscribe to Superfluid here:

This week’s edition of Superfluid is brought to you by Vanta!

Vanta helps businesses of all sizes establish trust by automating compliance needs across 35+ frameworks like SOC 2 and ISO 27001, centralizing security workflows, completing questionnaires up to 5x times faster, and proactively managing vendor risk. Over 10,000 global companies use Vanta to prove security in real time.

Get in touch with the awesome Vanta team: Andrew, Konner & Georgia

“[insert industry or ecosystem] is chronically underfunded. If we want to push for real innovation, we need real capital deployed here”. - [insert multiple VC panelists]1

Being underfunded is an easy problem to blame because no single entity or person controls the entire funding market nor will anyone take responsibility for a certain sector or founder profile being underfunded.

Yet when you see another CRM software company raise $50M to fund a conference merch-driven marketing strategy, it becomes clear that this isn't about availability of capital. It is entirely about allocation.

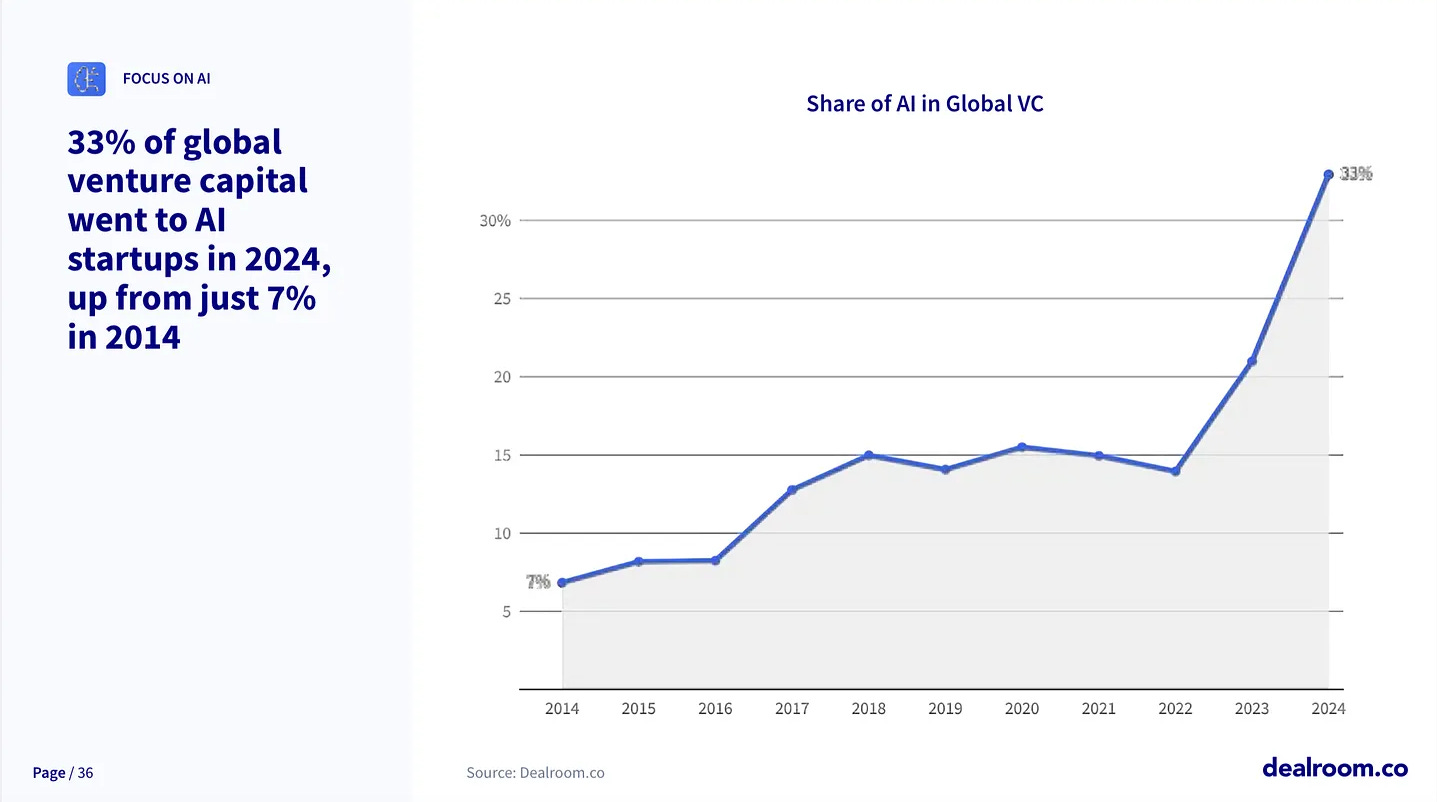

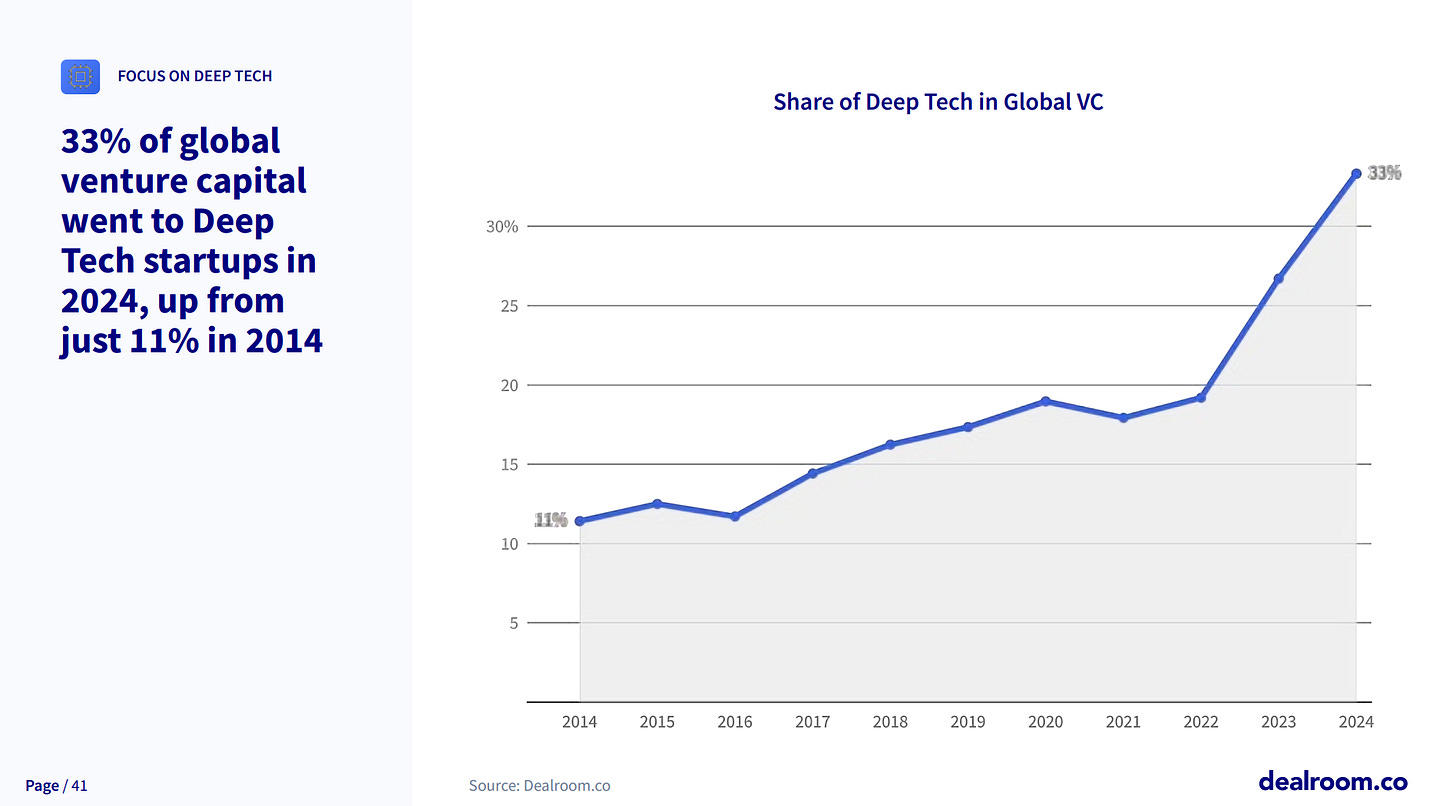

Looking at this dealroom.co report, the data tells a pretty stark story about where VCs are actually deploying capital in 2025 and it’s not particularly surprising.

In 2024, AI and DeepTech split the total funding market equally at 33% each and I would wager that in 2025, this split has only grown from here.

As I (and many others) have written extensively about the shift in the VC business model as larger funds are raised, the commonality between AI and DeepTech as broad sectors is that 1) both of these sectors can absorb enormous amounts of capital and 2) for a select few startups, the size of the market is bigger than anyone can fathom (but let’s just extrapolate that across the entire sector because why not).

This leaves us with what I call the Forgotten Middle. Companies building businesses that don't fit neatly into either the AI hype cycle or the DeepTech high CapEx profile.

Funding for this style of business is already down 63% YoY and likely to fall further, as most founders make the glaringly obvious narrative pivot to AI.

Whilst this is happening in the background, the real capital is flowing to areas that typically hasn’t seen much interest from VCs historically.

Just this week, Sequoia plowed $100M into indie arthouse movie production company, Mubi, following Thrive Capital investing $75M in A24 last year.

Whilst not traditionally seen as AI companies, it is clear that the underlying investment thesis is that AI can help reinvent Hollywood and as VCs investing in pure play AI companies, why not invest in film studios as well.

VCs are hunting for markets that are ‘non-traditional’ tech, in the hope that they can invest in a severely underpriced company that can be engineered to be venture-scale with a dose of AI.

Put more bluntly, have a distribution wedge in a market that VCs don’t typically invest, add AI to your business to make it efficient and you’ll probably be able to raise capital.

Whilst I think these investments give each respective business a shot at pursuing an interesting growth journey, if this strategy is magnified at scale (which other VCs are undoubtedly going to follow) then we’re going to have swathes of businesses constrained to a journey that might not make sense for them (i.e., being forced to blitzscale).

This week’s edition of Superfluid is also proudly supported by Notion!

Powering the world's best startups, Notion helps you build beautiful tools for your life’s work. In today's world of endless apps and tabs, Notion provides one place for teams to get everything done, seamlessly connecting docs, notes, projects, calendar, and email—with AI built in to find answers and automate work. Millions of users, from individuals to large organisations like Toyota, Figma, and OpenAI, love Notion for its flexibility and choose it because it helps them save time and money.

Startups get up to 6 months free with unlimited AI - over $6,000 in savings! Just click the link, fill out the form, select Superfluid from the drop-down list at the bottom and enter code STARTUP4110P49907 to redeem this offer.

Get in touch with Alex Dam and the rest of the awesome Notion team here!

So what should you do if you’re a founder building in the Forgotten Middle?

If you’re tossing up whether to raise capital or not and you feel like you are in a chronically underfunded bucket, then work through these prompts:

The current state of your unit economics and demonstrable growth

How complex is the problem you are trying to solve and how close are you to having a frictionless solution to this problem

How much of your problem is related to the physical world (i.e., atoms and not bits) or hard to digitise workflows

With increased competition across all markets, its only natural that the bar for companies that raise capital has also increased.

The VC path makes sense if you can demonstrate:

Very strong unit economics, and high growth (i.e., 300% YoY+)

High levels of complexity with multiple stakeholders and growing signs of product love

and finally, this isn’t mandatory but I think one that gives any startup an added layer of complexity and therefore defensibility:

Codifying hard to digitise workflows or recording physical world interactions that generate a valuable proprietary dataset are worth their weight in gold.

Even if your business doesn’t fit these criteria, you’ve got an awesome opportunity ahead of you, if you think proactively about your capital strategy.

The first thing to remember is that raising capital from VCs is not the only funding source available to you. Angels, family offices, non-traditional equity based funds, revenue-based financing and debt providers all exist to give you alternate sources of capital to a VC. Flashy VC backed newspaper headlines don’t make a great business.

Moreover, I actually think being underfunded can be a huge strategic boon. You’re forced to think more creatively and be more resourceful in how you approach solving problems. A great example of this is spinning up new revenue streams that can generate cash flow that you use to fund R&D in other parts of your business. I’ve seen 4-5 really great examples of this, which allow the business to breathe easier and provide more flexibility for the business’ growth journey.

Ultimately, the venture funding market is quite cyclical. What is forgotten today won’t be forgotten tomorrow and the market is going through its own structural shifts where investors are trying to figure out where their true incentives lie, when the game is actually about just backing strong fundamentals businesses.

So while it may feel frustrating to be in the Forgotten Middle, embrace the opportunity to build a sustainable business without the pressure of venture expectations.

Make sure to subscribe now to not miss next week’s article

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi

h/t to my wife who heard someone say this quote on a panel and laughed after we thought we had moved to a bigger market in the UK