Raising Your First Round of Capital

Understanding deal psychology and the capital landscape is important to figuring out where your first round of capital will come from

Welcome to all the new subscribers that have joined us over the last week! If you haven’t already, you should check out my last article here:

If you like what you read, please subscribe to Superfluid here:

Figuring out how to source your first round of capital is incredibly hard.

Do you approach angels first or do you approach pre-seed VCs?

What does pre-seed even mean?

Where do you find angels?

If you're a founder who doesn't have many connections in the ecosystem, it can be hard to make sense of the funding landscape. People are always using buzzwords and everyone's looking for deal flow. But how do you know where to spend your time and what the best approach is towards filling out your first fundraise?

To begin with, for your first round of capital, there are two routes you could go down. You can construct a round with:

Professional or Semi-Professional investors, or

Friends and Family

Whilst neither are necessarily mutually exclusive to each other, focusing on option 1 is likely the preferred choice given you will likely be able to raise more money and have better support post-investment.

Before you start fundraising, it's important to understand the following:

Deal psychology: Finding your first believer is hard, but finding the second and third will be a lot easier. The goal of fundraising is to find a strong investor who is willing to lead the round. Once you've done this, it will hopefully get easier to get other investors to commit to the round.

One of the things you need to optimise for when fundraising is finding that lead investor quickly and using that momentum to find other investors to close out the round. There are other ways of sequencing this, but from my experience, this method maximises your chances of success.

The longer you spend fundraising, the lower the probability of you raising a round. Remember, time kills deals.

The capital landscape in your country: The amount of funding options you have at the early stage is determined by how large and how sophisticated the startup/VC market is in your country. As an example, the US is by far the most mature funding market in the world. There have been numerous $1B+ exits meaning that there is a strong pool of people who have made a lot of money on startups already and are looking to back the founders of tomorrow.

As a result, whilst there are a ton of pre-seed funds and multi-stage funds that invest incredibly early in the US, there are also angel-led funds and 'super' angels who can lead rounds from both a capital and deal sophistication perspective.

On the other hand, in Australia, there are lots of pre-seed funds, a handful of multi-stage funds, and a small cohort of angel investors. Some of the pre-seed funds can lead, but most of the time they will either construct a party round or wait for one of the multi-stage funds to lead a round.

Once you've understood this, the next step is to create a list of potential early funding sources (this could be pre-seed funds, multi-stage funds, super angels, angel funds, CVCs or regular angels), and categorise them as either potential lead investors or follow-on investors.

To further clarify the distinction, lead investors do the bulk of the work associated with investing in your business. This can include doing thorough due diligence (that others might piggyback on), setting the terms for the round, issuing the term sheet and then negotiating the legal specificities for the round.

As a founder, it might not be immediately obvious who is a potential lead or if they are a follow-on investor so it's important to get that clarity in your first conversation with them. Once you know this information, it's easy to figure out which conversations to prioritise and when to sequence other conversations.

To source a list of professional investors that is specific to your country, I’d suggest you look at Crunchbase and other startup funding databases. To find angels, you need to be a bit scrappier and wider with your search. In most geographies around the world, programs such as Rampersand’s Giant Warm Intro are a great way to meet early investors and Angels. Alternatively, you can look at platforms like Angellist, or chat with other founders who have raised capital from Angels.

From here on out, the process is quite similar to the one that I detailed in my strategic guide to sequencing your fundraise. You can immediately go to step 2 in that guide and work from there.

In the guide above, I suggested talking to at least 50 - 100 investors. When looking for your first investor, you might need to talk to 100+ to get your first cheque. It's a tiring process and one that will test your resilience and ability to just persevere through all the rejections you get.

Unfortunately, through this process, it can be tempting to take any money that comes your way. Whilst your circumstances might require this, I'd heavily advise you not to raise your round in a piecemeal fashion through SAFEs.

One of the benefits of a SAFE is that you don't need to go through a ton of legal hurdles to receive investor capital. There are templated legal terms, and largely the only term that changes is the post-money valuation cap.

Given this flexibility, over the last few years, I've seen several founders raise their rounds by securing small cheques from a variety of people instead of focusing on securing a strong lead investor. In many cases, these SAFEs are issued over a while (6 - 24 months) and might even have different valuation caps depending on when they were issued. By doing so, founders unintentionally take on more dilution than they probably expect, which ends up putting off professional investors.

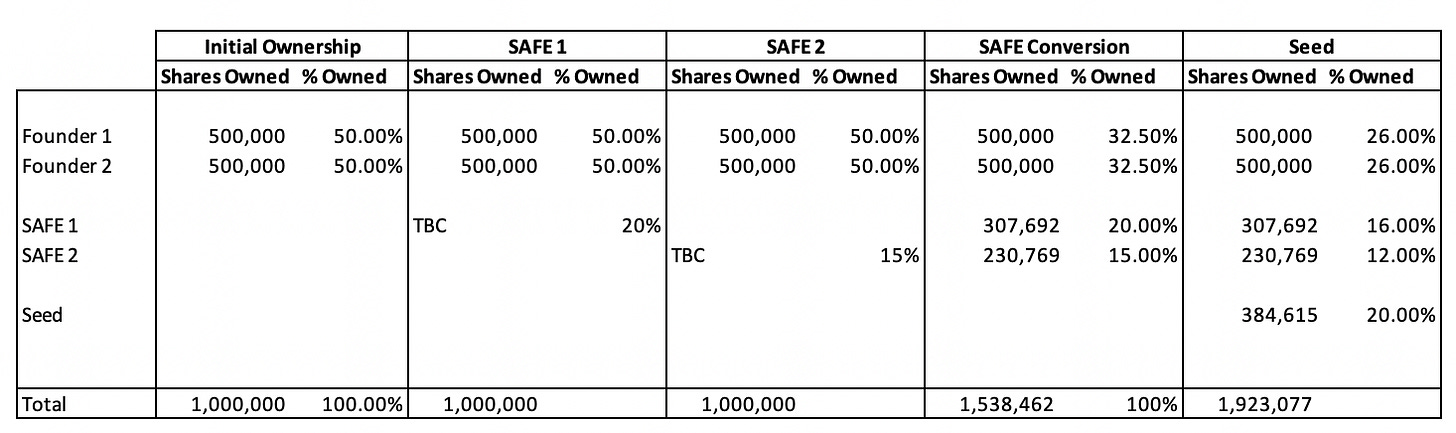

In the cap table above, I’ve simulated an early stage company that has done three rounds of funding:

SAFE 1: $500k at a $2M post-money valuation cap (20% dilution)

SAFE 2: $750k at a $5M post-money valuation cap (15% dilution)

Priced Seed Round: $2M at a $10M post-money valuation (20% dilution)

Since SAFEs only convert once a priced round occurs, it’s hard to see the dilution that takes place with each round of capital. In this scenario, the founders start at 100% ownership, and by the time the SAFEs convert and the seed round happens, they are down to 52% ownership. Keep in mind, in this scenario I didn’t implement a 10% ESOP. Doing so would dilute the founders even further.

Beyond losing control of your cap table, raising in a piecemeal fashion means that it's incredibly hard to deploy your investor’s capital appropriately in your business. Without a full understanding of the resources you have at your disposal, it's tough to prioritise the right strategic decisions.

As such, if you are struggling to find a lead investor, it's unlikely you'll be able to raise the full amount that you are targeting. That means you need to rethink and re-strategise your fundraise. Here's a quick process you can follow:

Collate a list of investors who are willing to follow a lead into the round

Calculate their total commitments (i.e., how much they have indicated they would want to invest)

If that figure is under 50% of your total round target, it's probably better not to raise a round now, and continue to bootstrap your business until there is further product development or customer traction.

If the figure is between 50 - 75% of your target raise amount, you should re-strategise what you would spend the capital on, the runway provided by this capital, what targets are realistic to hit and whether you're maximising your chance for success by taking capital on at this stage.

Once you've figured out the above, you can present a template SAFE note to the list of investors who are eager to participate. Make sure that the amount you raise does not over-dilute you, and that the valuation you propose is reflective of the maturity of your business (i.e., not too high or too low).

Now at this point, some investors will naturally drop off - they weren't really serious about investing in your business in the first place, they were just trying to preserve optionality in case an interesting fund led your round. For the investors who are still around, calculate the total amount they want to invest and go through steps 3 and 4 above. If the total is below 50%, my strong suggestion is to delay raising the round and continue to bootstrap.

Securing your first round of capital is meant to be hard. You're building a business that is in contrast to the status quo. Not everyone is going to be a believer in your vision, nor should they be. The key to running the entire process is being reasonable, strategic and focused on the outcome. Don't give into the desperation, but rather look to maximise the opportunity in front of you. For 99% of businesses, access to capital won't be the deciding factor for success.

Make sure to subscribe now to not miss next week’s article

How did you like today’s article? Your feedback helps me make this amazing.

Thanks for reading and see you next time!

Abhi